Wall Street-backed landlords now own more than 11,000 single-family homes in Charlotte

For decades, the single-family home rental market was a small-scale industry, made up almost entirely of local landlords who rented out a few houses they bought as investment properties, or perhaps inherited, or held on to after relocating.

But the years since the Great Recession have witnessed a dramatic shift, as Wall Street-backed rental companies moved in to snap up homes lost to foreclosure and replace mom-and-pop firms as America’s landlords. New companies like Invitation Homes, American Homes 4 Rent and Tricon American Homes purchased hundreds of thousands of houses, acquiring dispersed portfolios of properties and turning the suburbs into a lucrative revenue stream.

Now, with the foreclosure crisis in the rearview mirror and a historic scarcity of homes for sale, single-family rental companies are still adding to their portfolios, pushing into the regular market with all-cash offers and even, in a few cases, building brand-new subdivisions entirely made up of single-family rental houses. With a focus on buying moderately priced houses, single-family rental companies are impacting the supply of starter homes, possibly pushing lower-income and first-time buyers out of the market.

Their bets have paid off so far: The biggest firms own portfolios with hundreds of thousands of houses, generating big profits for investors. Some are publicly traded: Invitation Homes reported $196 million in profits for 2020, while American Homes 4 Rent racked up $155 million, for example.

It’s a big shift from the way the real estate market used to work, with a hard-and-fast division in most neighborhoods between rental housing (mostly in apartments) and owned housing (mostly single-family detached dwellings).

To see how deep Wall Street landlords have gotten into the Charlotte housing market, the UNC Charlotte Urban Institute analyzed Mecklenburg County’s property ownership database as of May 2021. We found that while they only own a small percentage of total houses, the new single-family rental conglomerates have built portfolios of houses heavily concentrated in the starter home segment of the market — where the supply crunch is tightest right now. And they’re still adding to their holdings, concentrating on suburban properties in mid-priced neighborhoods like Steele Creek and Highland Creek.

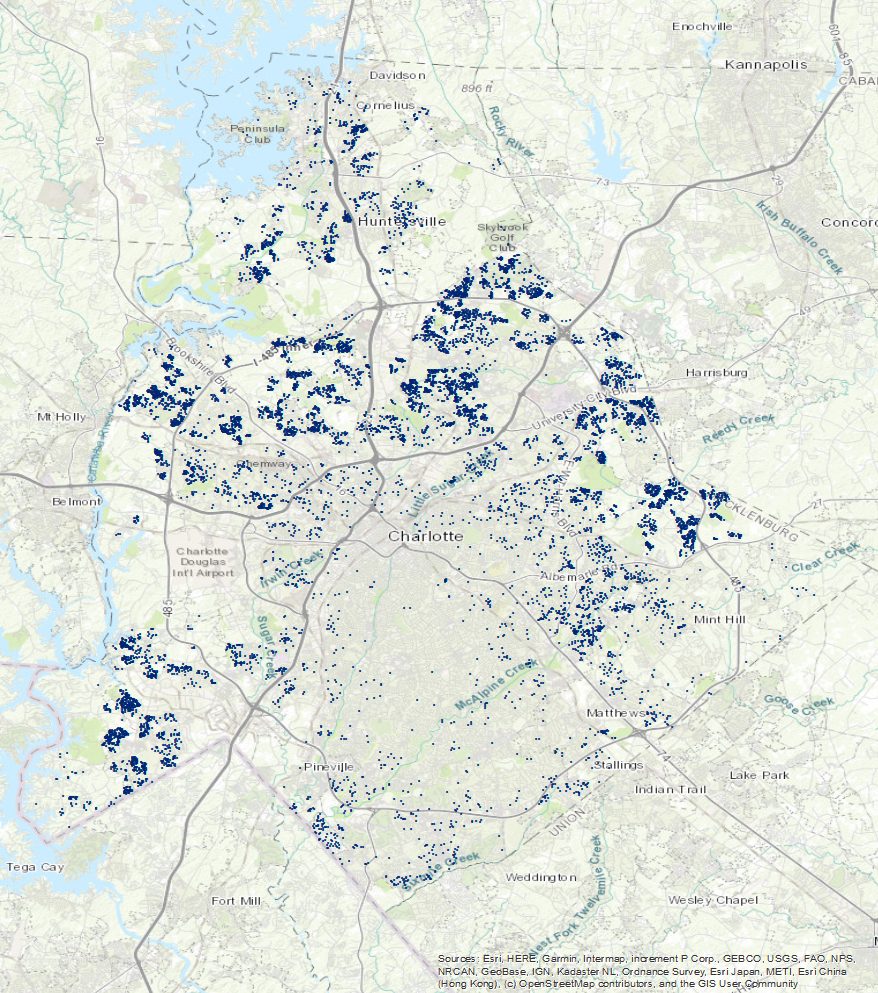

A map showing all the single-family institutional investor-owned homes in Charlotte. Credit: Justin Lane

A map showing all the single-family institutional investor-owned homes in Charlotte. Credit: Justin Lane

Here are some key facts about Charlotte’s the new single-family landlords:

- Within Mecklenburg County, their holdings total just under 11,500 houses. Those holdings are heavily concentrated among six companies: Progress Residential (2,268 houses); American Homes 4 Rent (2,242);Invitation Homes (2,241); Tricon (1,627); Amherst Residential (1,622); and FirstKey (1,044). To obtain these totals, the Urban Institute analyzed all property records to find owners with more than 100 houses in Mecklenburg.

- The average appraised value of single-family rental houses owned by the companies we analyzed was about $206,000. That’s well below the average appraised value of all single-family homes in Mecklenburg County, which is about $325,000, indicating that single-family rental companies are likely putting the most pressure on the lower end of the market.

- The single-family rental companies have tended to focus on middle-income neighborhoods, with fewer purchases in the higher income “wedge” of southeast Charlotte or the northern part of Mecklenburg that includes Davidson and Cornelius. This is consistent with their stated strategy of buying houses that appeal to middle-class professionals who, for whatever reason, aren’t interested in or able to buy. For example, as Invitation Homes states, “our acquisition strategy has been, and will continue to be, focused on buying, renovating, and operating high quality single-family homes for lease that we believe will appeal to and attract a high quality resident base, that will experience robust long-term demand, and that will benefit from capital appreciation.” Despite this focus, their houses are present in every part of the county.

- While our analysis focused on Charlotte and Mecklenburg County, most of these companies also own hundreds or even thousands of more houses in the surrounding counties, especially in high-growth areas like Union and Iredell counties. For example, American Homes 4 Rent says they own 3,811 houses in the greater Charlotte region, meaning that they own approximately 1,600 houses nearby in addition to the 2,242 we identified in Mecklenburg. These holdings are extremely valuable — the company says its Charlotte-area houses are worth $757 million.

- Despite the big numbers, the companies still hold a relatively small portion of the single-family home market: 4.3% in Mecklenburg. That’s because there are a lot of single-family homes — more than 268,000 in the county.

So is this ultimately good or bad for the housing market, residents and the Charlotte region? The companies say that they poured money into houses that might have otherwise deteriorated in foreclosure. American Homes 4 Rent says it typically spends $15,000 to $30,000 on renovations per house. They also standardize and formalize the rental market, with online portals for resident maintenance requests and other conveniences that a small operator might not be able to provide. And by opening up rental opportunities in neighborhoods that generally haven’t had them before, such companies might allow people without the means of buying a house to move their families to higher-performing school districts.

But in national reports, some residents have complained that the companies are slow to respond to maintenance requests and quick to file eviction papers. There’s also the matter of their effect on the housing market. Charlotte’s supply of homes is at historic lows, with less than three weeks worth of properties available (a healthy, balanced market is generally considered 4-6 months worth of supply). Meanwhile, prices are shooting up, increasing 16.4% in April to $377,643. That means Wall Street is competing with regular buyers in an increasingly crowded market, with people trying to buy houses squeezed on price and supply.

Buying houses in fast-growing cities with a low supply of housing is part of the strategy.

“We target submarkets and neighborhoods in undersupplied high-growth markets,” Invitation tells investors.

“Our strategy is to concentrate our properties in select geographic markets that we believe favor future growth in rents and valuations,” said American Homes 4 Rent. More than 60% of its housing portfolio is located in a handful of Sun Belt cities including Atlanta, Charlotte and Raleigh. The company also flags the end of the housing crunch as a risk factor: “the continuing development of single-family properties, apartment buildings and condominium units in many of our markets increases the supply of housing.”

In a decade, single-family home rental conglomerates have already started to reshape the housing market, and they appear to be dug in for the long haul, building homes designed as permanent rentals when they can’t acquire enough on the open market.

As American Homes 4 Rent — which acquired more newly built houses than existing houses in 2020 — put it in their latest annual report: “Our strategy of developing a significant pipeline of single-family homes for rent is relatively new and unprecedented…We are increasingly focused on developing ‘built-for-rental homes.”

As Charlotte and Mecklenburg County grapple with housing affordability — and single-family institutional firms keep buying up homes and building all-rental subdivisions — the continued presence of this new class of landlord is an important factor for the community to keep an eye on, and for further research.