Benefits Cliff Pilot Program Evaluation finds CLIFF Tools valuable for employees and job seekers

An evaluation of the Benefits Cliff Employer Pilot Program found that a new set of tools, called the Career Ladder Identifier and Financial Forecaster, also known as CLIFF, work to help employees and job seekers understand how higher earnings affect public benefits and make informed decisions to lessen the impact of the benefits cliff. Furthermore, the study finds important insights about earners’ experiences, highlighting that the severity of the benefits loss varies greatly among different public programs. Experiences also vary based on employment status and household needs, and workers and job seekers prefer higher pay over assistance.

The Benefits Cliff and Employer Pilot Program Evaluation

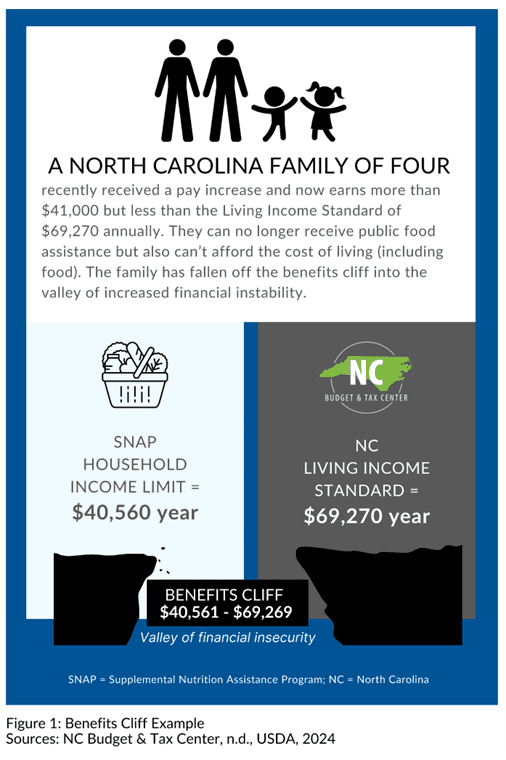

A benefits cliff occurs when “an increase in someone’s pay triggers a greater loss in public assistance”. Often, the raise is not enough to cover the loss in benefits, which can leave families without sufficient resources to meet their needs. Fear of the benefits cliff (i.e., losing assistance) can lead to turnover or keep employees from working more hours or accepting a pay raise or promotion (1-2).

To help those facing benefits cliffs make informed financial and career decisions, the Federal Reserve Bank of Atlanta, known as Atlanta Fed, created the CLIFF Tools. Led by Goodwill Industries of the Southern Piedmont, the CLIFF Tools were piloted at four employer sites. Researchers at the UNC Charlotte Urban Institute evaluated the outcomes of the pilot and data about participants’ understanding and lived experiences of the benefits cliff.

Summary of Key Findings

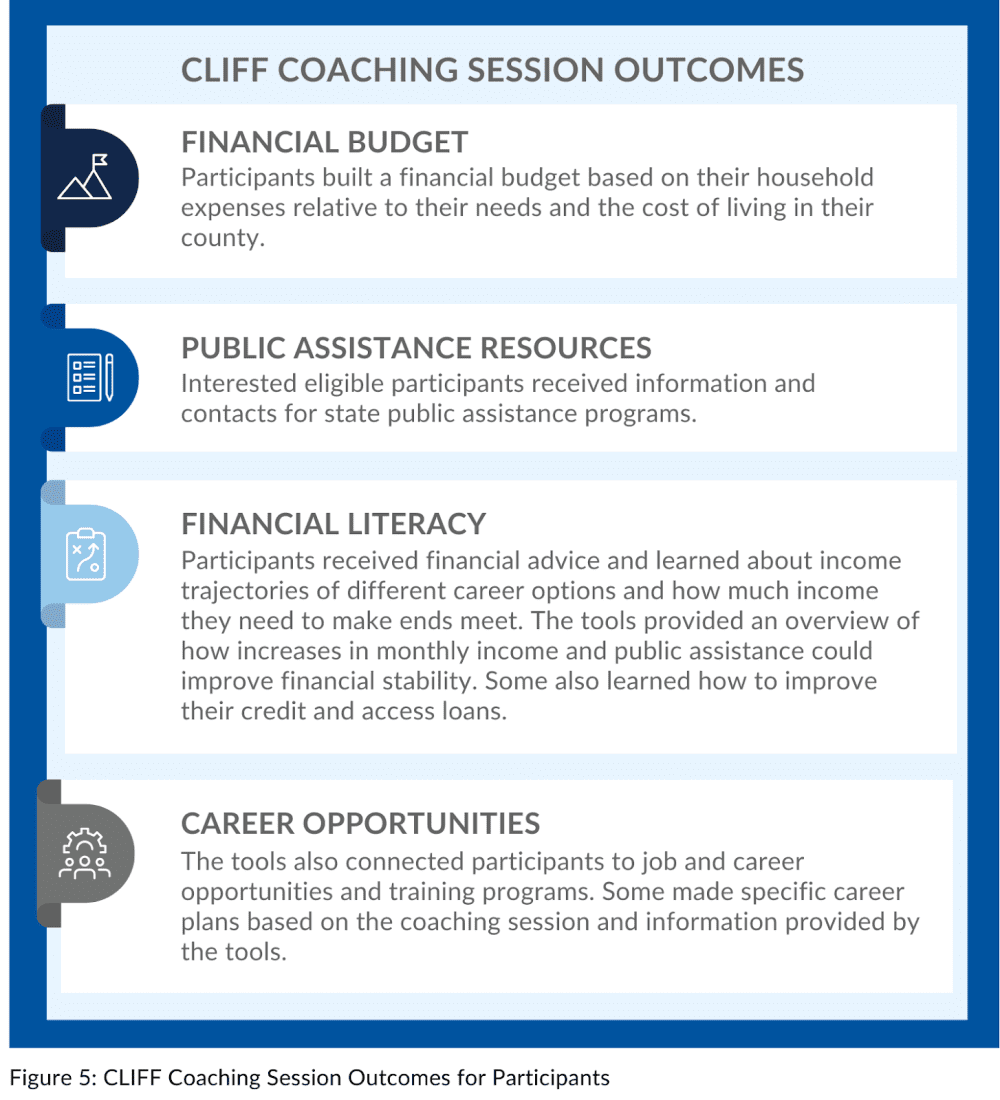

The CLIFF Tools helped 90% of participants make a plan of action, and one-on-one CLIFF coaching sessions provided financial literacy and planning tools, knowledge about public assistance programs that participants were eligible to use, and information about job opportunities and alternative career paths.

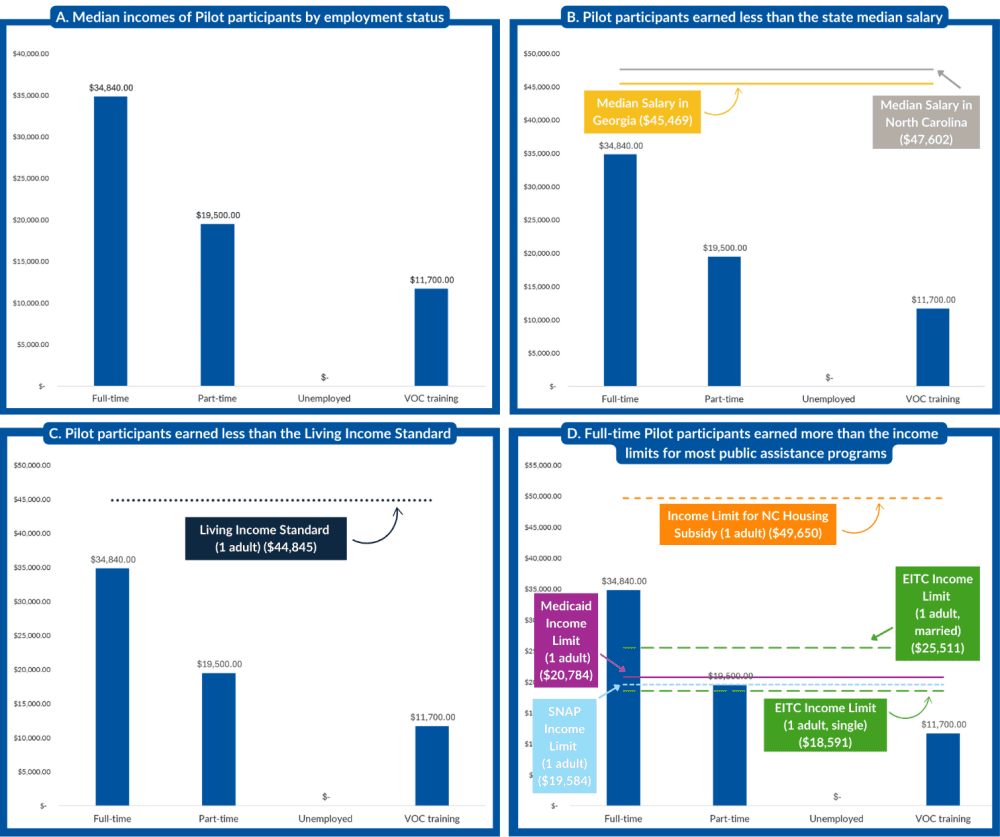

Around 40% of participants had experienced the benefits cliff. SNAP/WIC (i.e., food stamps), rental assistance, earned income tax credits, and healthcare assistance were the most common assistance programs to be impacted with income increases. The steepness of the benefits loss varied greatly across different public assistance programs–some had a gradual decline in assistance while others had a very steep decrease or completely terminated assistance after slight increases in income. Despite losing public assistance benefits, which was often paired with increasing living expenses (e.g., higher rent with the loss of housing subsidies, higher taxes), the majority of participants would still accept higher pay. They valued self-sufficiency over public assistance.

Most participants, particularly full-time employees, had incomes too low to meet their basic needs but too high to qualify for public assistance.

Recommendations for Implementing the CLIFF Tools in the Workplace

Below are things that worked well for using the CLIFF Tools among employees or job seekers, as well as recommendations for best practices.

- Training CLIFF Tool facilitators: Facilitators that will use the tools with employees should complete training by the Atlanta Fed and be educated on public assistance programs, local resources, and ethics.

- Establish trust first: The tools require inputting personal information. Facilitators should first build a trustful relationship, which includes being transparent about how the information is used and protected.

- Understand needs and goals: Facilitators should learn about employees’ needs and goals to decide which CLIFF Tool is best suited and provides the most value for the employee.

- Critical periods: There are situations when employees are more vulnerable to or most impacted by the benefits cliff. The CLIFF Tools should be used during these critical periods, such as when someone changes jobs, their child ages out of benefits, or they get a raise.

Additional Opportunities for Employers to Mitigate the Benefits Cliff and Consequences

Beyond using the CLIFF Tools, employers can work to increase wages that match the Living Income Standard. They can also allow flexible working times and spaces, provide advance pay for emergencies, and advocate for policies that would mitigate the impact of benefits cliffs on workers.

References:

HUD Public Housing Program (n.d.). https://www.hud.gov/topics/rental_assistance/phprog

Roll, S. (2018). Examining the child care cliff effect in a rural setting. Social Work and Society, 16(1), 1–13.

Ruder, A., & Terry, E. (2024). Benefits Cliffs Coaching with the Atlanta Fed’s CLIFF Tools : Implementation Evaluation of the National Pilot (Issues 1–24). https://doi.org/https://doi.org/10.29338/dp2024-01

NC Budget & Tax Center. (n.d.). Living Income Standard. https://ncbudget.org/lis/

USDA Food and Nutrition Service (n.d.). SNAP Eligibility. https://www.fns.usda.gov/snap/recipient/eligibility

U.S. Bureau of Labor Statistics. (2024). BLS Data Viewer: Weekly and hourly earnings data from the Current Population Survey. https://data.bls.gov/dataViewer/view/timeseries/LEU0252881537

IRS. (n.d.). Employer shared responsibility provisions. https://www.irs.gov/affordable-care-act/employers/employer-shared-responsibility-provisions

NCDHHS. (2024). Do I Qualify? https://ncchildcare.ncdhhs.gov/Services/Financial-Assistance/Do-I-Qualify

HUD Housing Choice Voucher Program. (n.d.). https://www.hud.gov/hcv/tenants