Employment and Wages in Charlotte: Financial Industry and Beyond

Charlotte, like much of the nation, has been affected by the economic recession that began in December 2007. Job losses and unemployment extend across nearly all economic sectors, leaving virtually no region or industry immune from the downturn. Due to the tenuous situation of banking and finance industries during the recession, Charlotte’s unique position as a national leader in financial activities and home to Bank of America and Wells Fargo-Wachovia added additional stress on local economic activity. Troubles experienced by financial firms throughout the recession were quite visible in Charlotte with the acquisition of an insolvent Wachovia by Wells Fargo and the much scrutinized acquisition of Merrill Lynch and subsequent TARP loans by Bank of America.

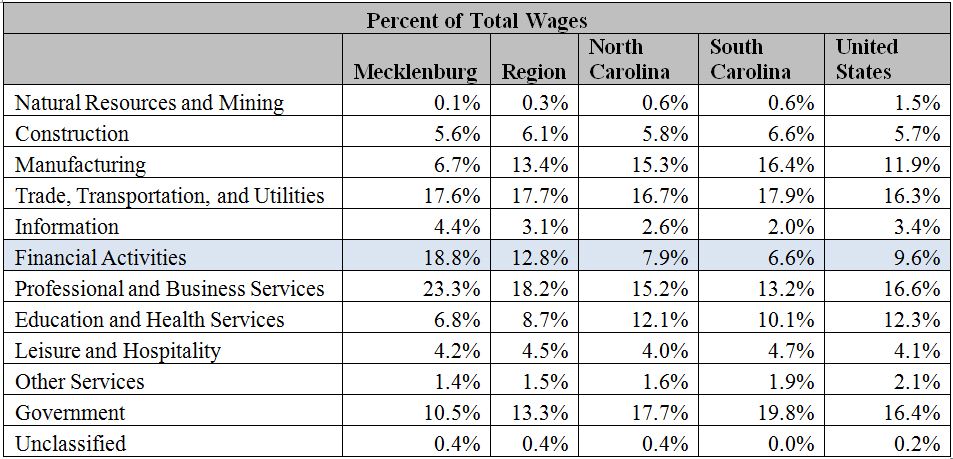

Charlotte’s status as the 2nd largest financial center in the country (behind only New York City) is a source of pride for many in the community and has stimulated unprecedented economic growth and wealth for a once textile dominant southern piedmont town. It is no surprise there are concerns over what impact a significant loss of financial employment would have on the city’s and region’s economy. Aside from the direct loss of jobs the greatest impact on the city would be the disappearance of the above average wage rates of many financial sector employees, thus reducing discretionary income spending throughout other economic sectors. What do financial industries contribute to the city and region in terms of employment and wages? Should there be concern over possible financial industry employment loss?

This paper describes the current economic profile of Mecklenburg County (as a proxy for Charlotte) and the fourteen-county region in terms of employment and wages, with attention given to the financial industry and role it has in the overall economic landscape. It will illustrate that, while the financial industry has a significant employment base, Charlotte contains major concentrations of employment in economic sectors beyond finance. However, the financial industry contributes large amounts of wealth to the region through high wages that are often difficult to replicate in other industries. Higher wages in turn impact broader economic growth through increased spending.

Photo by Nancy Pierce