The historical roots of the racial wealth gap in Charlotte

This is the second in an ongoing series, based on a report by the Urban Institute. Read Part 1 here. The report was compiled with support from Bank of America, which partners with the UNC Charlotte Urban Institute and the Institute for Social Capital on research that provides insight into community initiatives. Join us each Wednesday at 7:30 p.m. on Twitter for a discussion, using the hashtag #WealthGapWednesdays to follow along and ask questions.

Wealth is more than money. While simply defined as the net amount of assets over liabilities, wealth functions in more expansive ways. It opens doors to homeownership, no-debt or low-debt education, business ownership, and the ability to weather personal and national emergencies.

These opportunities and the racial wealth gap that locks some groups out — White households in the United States have 10 times the wealth of Black households and 7 times the wealth of Latinx households — have historical policy roots.

Historical Roots

The Brooklyn neighborhood, once located in Charlotte’s Second Ward, was a thriving Black community — until the bulldozers rolled in, hailed by city leaders and backed by the full weight of federal policy. The story of urban renewal in Brooklyn is one of many such stories shared across the nation. Federal, state, and local policies upended wealth and generational potential in Black, Latinx, and Indigenous communities.

[The Racial Wealth Gap in Charlotte-Mecklenburg: Read the new report]

Urban renewal was just one of many policies that have contributed to the racial wealth gap since European settlers arrived.

Slavery and the seizure of Indigenous lands and resources powered the economic system and seeded the racial wealth gap in the U.S. Laws and reforms such as Jim Crow, the New Deal, and the GI Bill also explicitly and implicitly excluded certain populations from building wealth.

| The Racial Wealth Gap |

| Part 1: COVID-19 exposes the impact of the racial wealth gap |

Housing, transportation, labor and criminal justice policies among other policies, have contributed to and sustained the racial wealth gap over generations, despite many reform efforts.

Here’s a look at some key features of wealth accumulation and how they’ve historically hindered members of marginalized communities:

- Housing Policy. “Redlining” was a federal practice of rating neighborhoods based on perceived financial risk and then systematically denying loans or services in the areas marked in red that were perceived as too risky for investment. Nonwhite communities were redlined, preventing the flow and benefits of investment, depressing housing markets and limiting the home equity that Black homeowners were able to build. Subsequent public housing policies, including urban renewal and Hope VI (federal program aimed to transform public housing), demolished and cleared mainly Nonwhite neighborhoods with the promise of better housing — a promise that was largely unfulfilled. In Charlotte, historian Tom Hanchett wrote, “urban renewal demolition displaced 1,007 Brooklyn families. Brooklyn’s entrepreneurs had less luck at relocation, the old district’s density and central location had provided a warm environment for small shops, both on the black main street along Second and Brevard and on street corners throughout the neighborhood. Urban renewal displaced 216 Brooklyn businesses. Many never reopened.”

- Transportation Policy. In urban areas like Charlotte, largely nonwhite neighborhoods that were redlined were also divided and demolished for federal and local highway development. Former Charlotte Mayor and U.S. Secretary of Transportation Secretary Anthony Foxx said in a 2016 interview, “we now know – overwhelmingly – that our urban freeways were almost always routed through low-income and minority neighborhoods, creating disconnections from opportunity that exist to this day.” He knew this first-hand as his own family home in Charlotte was blocked by two freeways, I-77 and I-85.

- Labor Policy. Industries dominated by Black and Latinx workers, such as farmhands and domestic laborers, were excluded from protections and benefits such as Social Security.

- Criminal Justice Policy. Prisoner forced labor and unequal sentencing guidelines disproportionately impacted Black communities. Black men are sentenced for longer periods for the same crime and are nearly 6 times more likely to be incarcerated than White men.

Wealth as a Safety Net

These policies have enabled certain families to build wealth while excluding and limiting others. The accumulated wealth serves as a safety net for recessions, job loss, illness and other unanticipated tragedies.

Amid the coronavirus crisis, those that lack wealth and the safety net it provides are hit hard. Some families will dig into, and likely exhaust, existing savings to get by during this unprecedented time of high unemployment — if they have savings at all.

In Charlotte, 37.3% of families experience asset poverty, meaning they do not have enough assets or savings on hand to pay for basic necessities for three months without income. Households of color are more than twice as likely to experience asset poverty than White households (42% and 18%, respectively).

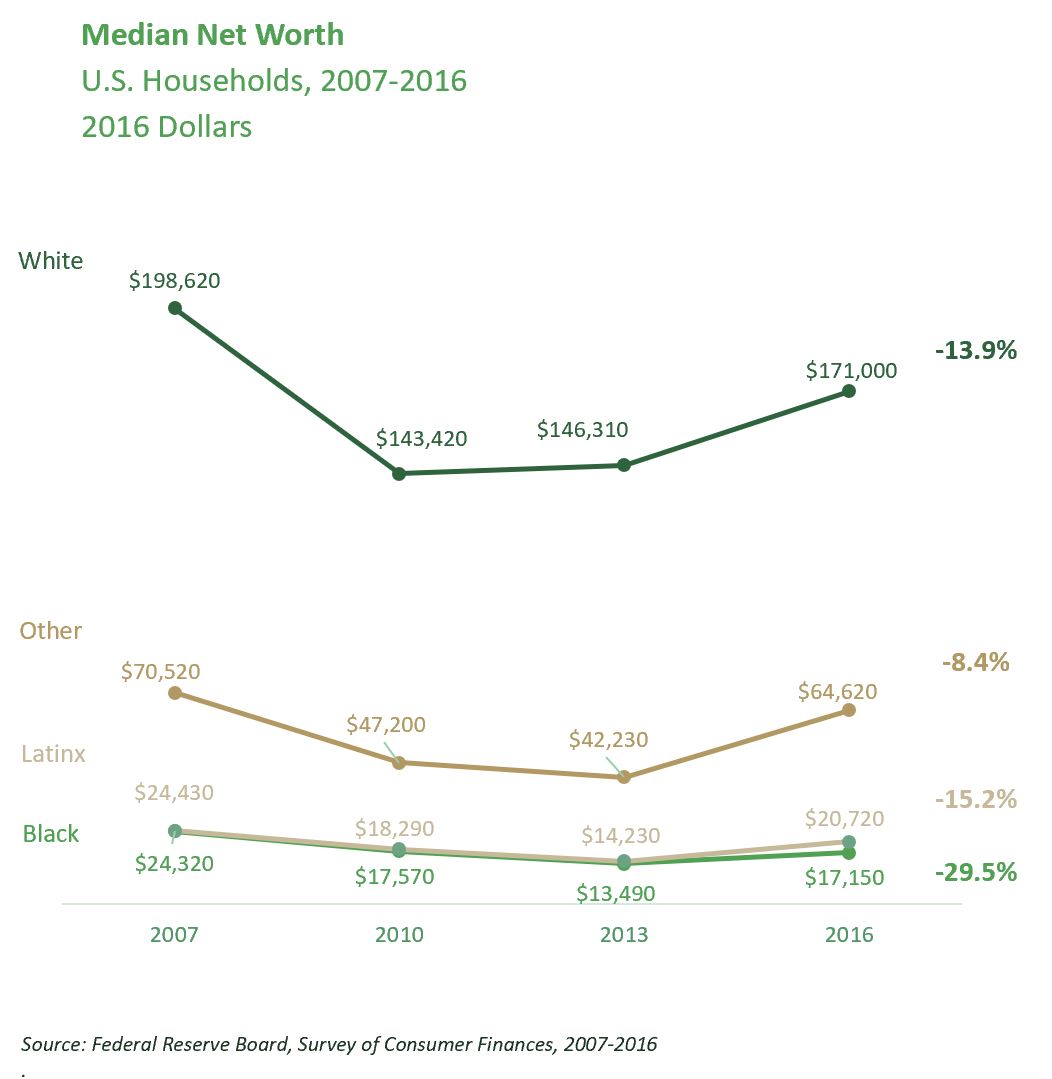

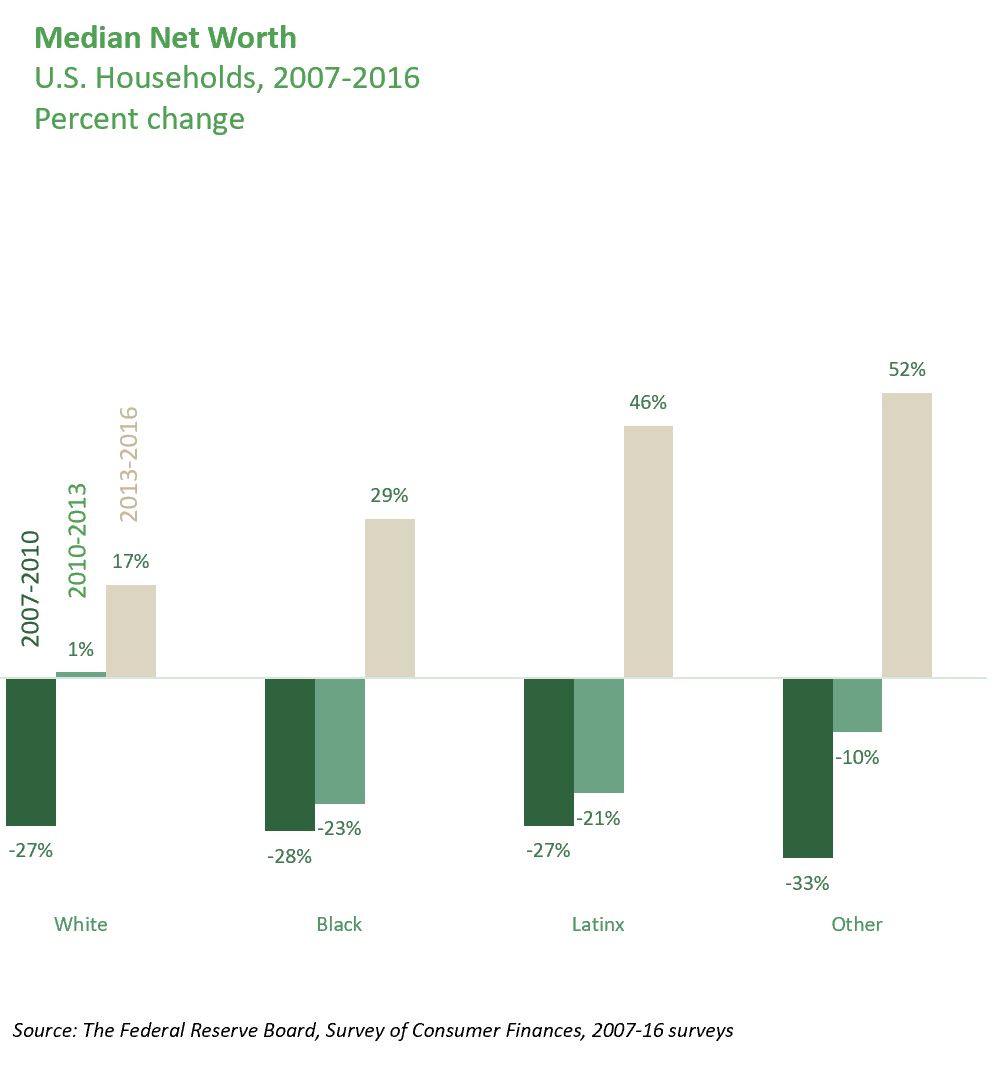

The impact of crises further widens the racial wealth gap, leading to greater inequity and limited safety nets when another crisis arises. The Great Recession (2007-2010) negatively impacted the net worth of all households, but White households were able to recover quicker. Overall, White households lost 13.9% of their wealth between 2010 and 2016 — while Black households lost 29.5% of their wealth, further widening the racial wealth gap.

In the period following the recession (2010-2013), White households stopped losing wealth and began to recover, while Black and Latinx households continued to lose pre-recession wealth. Not until several years later did median net worth begin to rise among these households.

Understanding the racial wealth gap is a challenge

Identifying simple causes of this disparity is challenging. The racial wealth gap in the United States has been historically shaped and sustained by multiple policies and legal practices. This historical variation and complexity leads to significant measurement challenges and makes wealth difficult to understand. Wealth, and access to it, is complex in several ways:

- First, wealth is multifaceted rather than unidimensional. Wealth is about more than income, home equity, or any one asset alone.

- Second, it is cumulative, rather than a point-in-time phenomenon. Wealth develops over time. The wealth of grandparents and great grandparents helps build wealth in subsequent generations. And likewise, the impact of Urban Renewal builds on the impact of Jim Crow.

- Third, wealth is structural, rather than individual. Conventionally, efforts to address gaps in wealth and income have focused at an individual or household level, assuming that the underlying problem is in individual behavior, beliefs, or values. However, the roots of the racial wealth gap are systemic, erected by historic economic and social policies.

Because of this complexity, closing the racial wealth gap will require understanding and addressing multiple facets — housing, income, and now, the impact of the novel coronavirus.

This pandemic is both a spotlight and a warning, highlighting the inequities already built into our economic and social systems and the dangers if we persist in not correcting them. History is not destiny, and systems are not permanent. We have an opportunity to address the impacts of this history — but only if we choose to do so.