Myths about closing the racial wealth gap

This is the seventh and final article in a series, based on a report by the Urban Institute. The report was compiled with support from Bank of America, which partners with the UNC Charlotte Urban Institute and the Institute for Social Capital on research that provides insight into community initiatives. Join us Wednesday at 7:30 p.m. on Twitter for a discussion, using the hashtag #WealthGapWednesdays to follow along and ask questions.

Wealth is complex. It grows over generations, helped or hindered by government policies and practices, flowing to and away from families over separate and compounding pathways.

That’s a key reason why solutions focused on building individuals’ capacity to attain or grow a single asset — such as homeownership or a higher income — have not measurably shifted racial wealth disparities in the U.S. and will not fully close the racial wealth gap. Due to the multifaceted and cumulative nature of wealth, solutions need to focus on narrowing gaps in multiple asset categories that make up wealth.

[The Racial Wealth Gap in Charlotte-Mecklenburg: Read the new report]

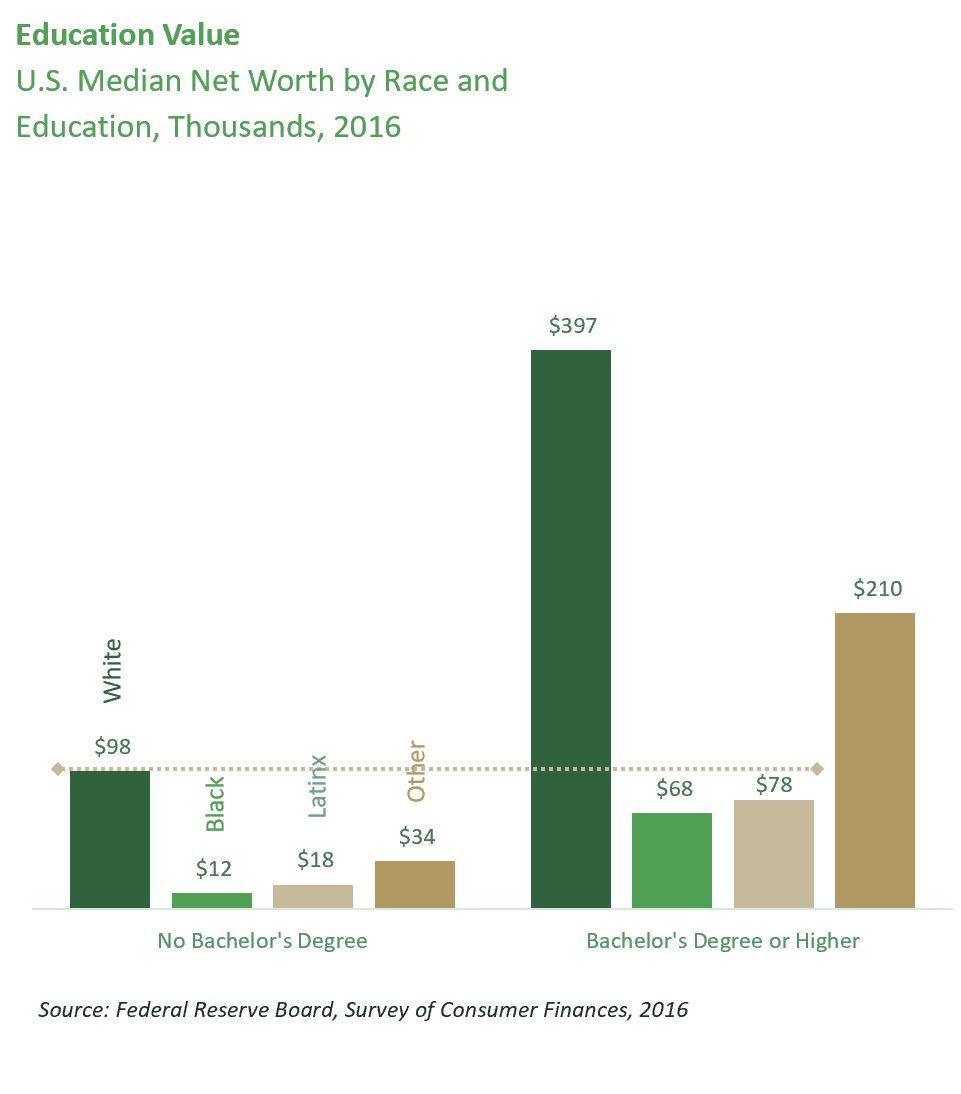

Most efforts to increase economic stability operate under the assumption that helping individuals increase one key asset will eliminate wealth disparities. Educational attainment, long seen as the surest path to equality, is a great example. Education broadens career choices, enhances specialized skills, and raises earnings. But the value of an education — and specifically its impact on household wealth — varies considerably across racial and ethnic groups.

The Racial Wealth Gap

- Part 1: COVID-19 exposes the impact of the racial wealth gap

- Part 2: The historical roots of the racial wealth gap in Charlotte

- Part 3: Home ownership and the legacy of redlining: Charlotte’s racial wealth gap

- Part 4: How income and industry contribute to the racial wealth gap

- Part 5: Business ownership and entrepreneurship

- Part 6: Savings, investment and the racial wealth gap

The data are clear: obtaining a college degree is not enough to close the racial wealth gap.

Higher education and obtaining an advanced degree raises household income and is widely recognized as an asset-building strategy. In Mecklenburg County, 43% of adults have a bachelor’s degree. People who hold those degrees, however, are concentrated in a southeast Charlotte wedge. These rates reflect the continued impacts of redlining practices and racially driven policies that left historic African American neighborhoods economically and physically devastated.

Within groups, additional levels of educational attainment lead to greater income and net worth. Across groups, however, similar educational attainment does not correlate with similar household net worth.

In other words, a college degree drives more wealth for White households than for Black and Latinx households.

This results in major wealth disparities: Black families with a college-educated head of household have about $30,000 less net worth than White families whose head does not have a bachelor’s degree. This is clear evidence that education alone will not close the racial wealth gap.

The racial wealth gap also contributes to who can and who cannot pay for college. White families typically have the ability to pay more toward a college education, which can require less student loan debt. In Mecklenburg County, Indigenous, Black, Latinx and other students of color incur more student debt than their White peers. Their loans also end up in student debt collections at twice the rate of White students, further impacting gains to net worth.

Our commitment

We recognize that addressing the racial wealth gap is dependent on systemic and structural solutions rather than the individual solutions that have placed the weight of societal change on the survivors of racial inequity. The UNC Charlotte Urban Institute will continue work like the Racial Wealth Gap series with the guidance of our community and we commit to examine our role in the problem of racial inequity and our contribution to solutions.

Black college graduates are also more likely to support their families than White college graduates, further impacting potential gains to net worth.

Now, there’s another challenge. COVID-19 has derailed any normalcy in education. College presidents across the country are concerned about the impact of COVID-19 on students from families with low incomes and students of color, recognizing that even in the best of times, these students face greater threats to their wellbeing that may cause them to fall behind or not complete their degrees.

Changing individual behavior will not close the racial wealth gap.

Another widely held assumption is that individual behavioral changes will close the racial wealth gap. Efforts have predominantly focused on attaining or building individual assets by addressing the behaviors, values, or skills of individuals and households. These solutions often assume dysfunction or ignorance lies at the root of wealth, along with other racial and ethnic differences, despite evidence that dispels these beliefs (i.e., when controlling for income, Black families save the same or slightly more than White families).These assumptions ignore longstanding policies and practices that have created the vast racial wealth gap we see today.

Changes in individual behavior cannot overcome our nation’s history of governmental policies and practices that facilitate and sustain the racial wealth gap. No change in individual behaviors, values, or skills can materially make up for exclusion from the housing market and labor policies; the destruction of wealth and wealth-generating potential through planning, transportation, and criminal justice policies; and intergenerational wealth protected and built through tax policy.

Catawba College graduates in 2010. Photo: Nancy Pierce

Closing the racial wealth gap in Charlotte

It would be tough to close the racial wealth gap through local policies when the mechanisms behind such disparities are rooted in national policies and practices. But that doesn’t mean local and state governments should shy away from trying.

Policymakers, community leaders, change-makers, and others need to understand that strategies to meaningfully close the racial wealth gap must look beyond assumptions that rely on a single asset building strategy and individual behavior change. Reparations, baby bonds, smart decarceration, and small business capitalization and scaling support are a few examples that can happen at the local level.

The concepts that follow can inform strategies implemented at the local, state, and national levels.

First, focus on fixing systems, not people. As noted by William Darity, Darrick Hamilton and colleagues, while individual solutions are “not necessarily undesirable, they are wholly inadequate to bridge the racial chasm in wealth.” Local proposals should instead challenge the way institutions and programs limit wealth for households of color. This could include financial institutions addressing discriminatory lending practices and creating trusts for children, and local governments directing investments to families of those displaced during urban renewal and highway construction.

Second, use a targeted approach. john a. powell, a guest of the Charlotte Opportunity Task Force in 2015, describes the practice of “targeted universalism” — setting goals that benefit all and then specifically targeting strategies in order to create “structures and systems that advance all the groups to the universal goal.” Another way of thinking about this is to approach solutions with a universal race-consciousness lens. This means that wealth and assets can be achieved irrespective of the race or financial position in which they are born.

For example, a goal of economic prosperity for all Charlotteans will require specific tailored strategies to address the particular systemic barriers faced by different racial and ethnic groups and will ultimately result in economic prosperity not being determined by race and/or financial situations.

Finally, given the complex and cumulative nature of the racial wealth gap, solutions should be combined within and across systems, and in the case of the racial wealth gap, across generations. For example, children’s savings accounts paired with down payment assistance for the parent address multiple dimensions of the wealth gap. As powell notes, it takes a “multiplicity” of strategies to get all groups to universal goals.

Closing the racial wealth gap is not a small undertaking. The COVID-19 pandemic has exposed longstanding inequities from health to safety to economic well being. This moment poses an opportunity to closely examine our systems and rebuild them to work for everyone. History is not destiny, and systems are not permanent. We have an opportunity to address the injuries of history — but only if we choose to do so.