Single-family construction once dominated Mecklenburg, but that’s changed

At 500 West Trade Street in uptown Charlotte, another luxury apartment building is under construction. The 350-unit complex, developed by Northwood Ravin, sits on the site of the now demolished James K. Polk building.

The Polk building was built by C.C. Coddington in 1925 to serve as a Buick dealership, and for a time housed the WBT (“Watch Buicks Travel”) Radio station. Constructed in the 1920s neoclassical style by Albert Kahn, it was one of the few remaining buildings in the city center from that era. But years of neglect left the exterior crumbling, and hopes of salvaging the building evaporated.

The Polk building was one of many torn down to make way for new multifamily housing. After the 2008 recession, apartments came to dominate housing construction in Charlotte. What factors led to this, and will this furious pace of construction be sustainable?

Mecklenburg’s Housing Trends

An analysis of Mecklenburg’s building permits shows that, at the peak in 2006, over 8,000 detached homes were built in Mecklenburg County. Between 2002 to 2008, single family permits averaged 56 percent of overall housing construction.

Since then, market share has fallen considerably. From 2009 to 2019, single family housing had fallen to an average of only 40 percent of all new construction.

In 2011, the annual number of permits issued for multifamily units overtook those issued for single family homes. By 2018, permits for new multifamily homes reached 8,000 individual units, nearly surpassing the peak annual level recorded for single family homes. Real Page, Inc. named Charlotte as the fastest-growing market in the U.S. for apartment construction.

Condos, on the other hand, have lost much of their appeal. In the wake of the Great Recession, some developers were stuck with unsold units as demand plummeted. Some projects, like the Vue, were eventually repurposed as apartments. Fear of repeating the past might have tempered developers’ desires to enter the market again.

Market Forces Driving Change

Jeff Harris, Carolinas Division President of multifamily developer LMC, points to three major factors that changed the housing market:

1. Millennials are forming households but remaining renters

According to a 2015 report from the Census Bureau, the 83 million U.S. Millennials are now the largest age group, outnumbering Boomers by about 8 million. Many of these Millennials, typically defined as being born between 1982 and 2000, exited high school or college to find themselves in a bleak job market. Years of unemployment or underemployment delayed their financial ability to save up to purchase housing, leading them to find rental housing instead.

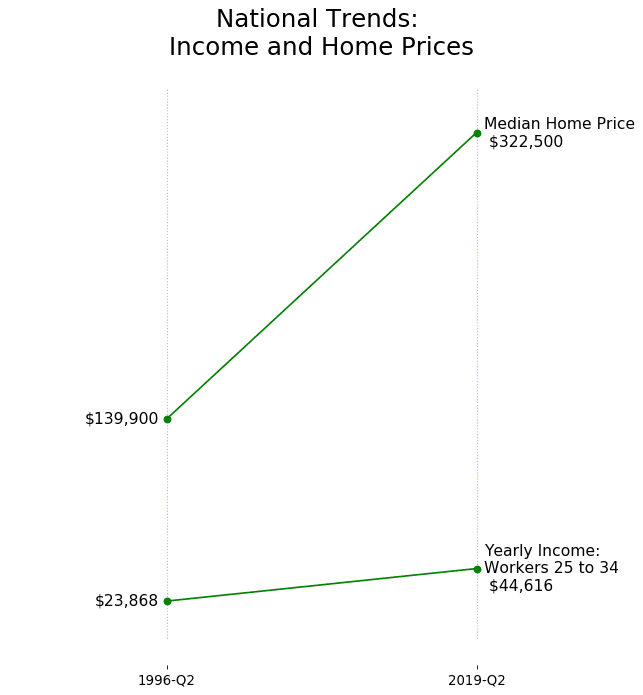

Nationwide, younger home buyers face a growing challenge when purchasing a home: median home prices have grown faster than wages. According to the Bureau of Labor Statistics, from 1996 to 2019, median earnings for workers aged 25 to 34 rose by 87 percent. During that same time, median home prices rose by 131 percent. In 1996, the median home-price to income ratio for that age group was 5.9. Since then, that ratio has increased to 7.2.

Source: Bureau of Labor Statistics: Wages for 24 to 35 year olds. FRED: Median sales price of houses sold in the US.

Increasing land values, home size, quality, and construction costs have all contributed to rising housing costs. Adding to this, outstanding student loan debt has more than tripled since 2006. These factors have limited the purchasing power of recent graduates.

2. “Single-family for-sale housing production capacity [was] decimated”.

Single-family construction fell dramatically after the 2008 financial crisis. Nationwide, new home permits are now at levels on par with the mid-1990s.

This decline could be due to many factors. Years of relentless building followed abruptly by a lending crunch created an oversupply of homes. Builders and lenders became hesitant to invest in new developments . Many closed up shop.

Adding to the problem, land values have steadily risen. The State Of Housing in Charlotte report found that land values in Mecklenburg rose 21 percent from 2012 to 2017, to $198,000 per acre. Land values soared regionally as well. In Lancaster, the price per acre of undeveloped land grew by 37 percent during that time.

“Increasing land prices drive the market toward higher density housing, and reduce the relative costs of commuting,” the report said. High-density projects like apartments and townhomes allow land costs to be distributed over more units.

Land scarcity is at least part of the cause of the rising land prices. Only about 18 percent of land in Mecklenburg is considered vacant.

3. “Home ownership rates returning to historical norms from the artificially increased levels spawned by the mortgage industry pre-crisis.”

In her article Homeownership and The American Dream, Laurie Goodman notes that homeownership rates rose throughout the mid-90s and 2000s, reaching over 68 percent, only to fall after the 2008 housing crisis. By 2015, rates were at 62.7 percent, still less than the 1985 level. The only age group to experience an increase in homeownership were households 64 and over.

While there were major demographic changes occuring over this time such as increasing education levels, an aging population and declining birth rates, those factors alone are not enough to fully explain the drop in homeownership. After controlling for demographic variables, the authors find that:

“Expanded access to credit contributed to the rate’s rise through 2005, and the effects of the Great Recession, in combination with stagnating real wages, student loan debt, tight credit, and subtle changes in attitudes toward homeownership, contributed to its decline from 2005 to 2015…The Great Recession and the subsequent pullback in credit has had a significant impact on the homeownership rate, with a 7 percent swing from 2005 to 2015 that cannot be explained by demographic factors.”

Despite the increase in apartment construction, Harris doesn’t believe the market is over- saturated. LMC is making a massive investment with The Ellis, a 33 story apartment high rise in Uptown along the Blue Line Extension.

“We are not seeing the typical signs of overbuilding (slower lease-up velocity, increased concessions) and stabilized properties are at or above what historically has been considered to be “full” occupancy of 93 percent,” Harris said. “As long as Charlotte continues to grow and add jobs, the multifamily housing stock should grow along with it.”

Where are the apartments going?

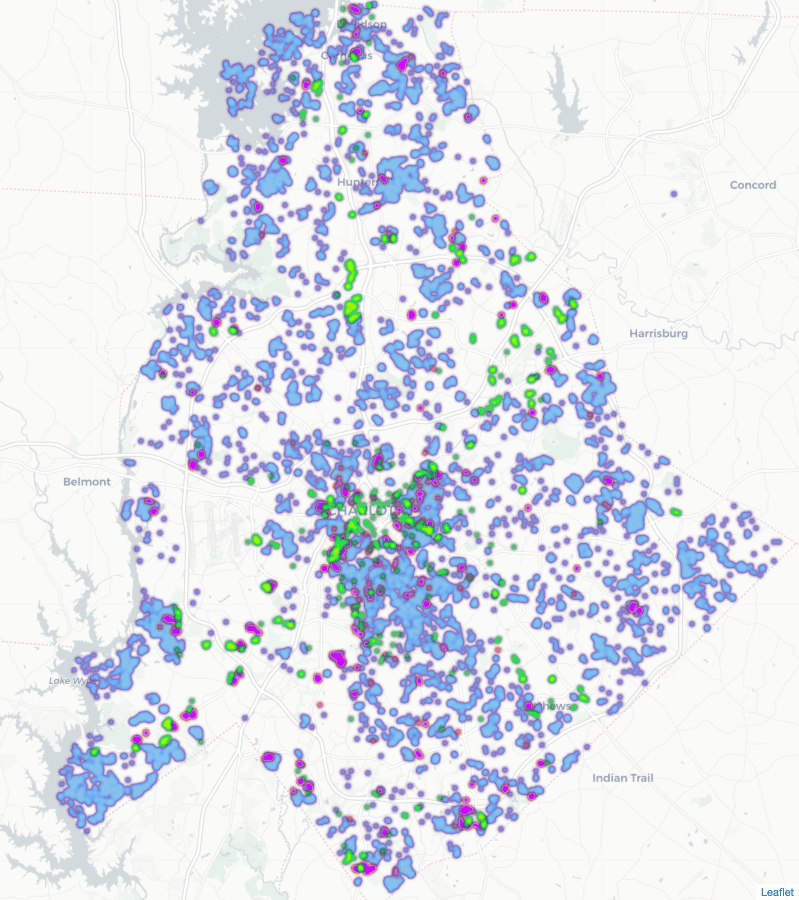

Apartment construction has been concentrated in the most urban areas of Charlotte, such as uptown, South End, NoDa and Plaza Midwood. Development has also been strong along transit routes such as the Blue Line, Interstate 85 and Interstate 77. The University Area has attracted growth in student style housing.

Suburban areas, too, are seeking an urban feel; Steele Creek, Ballantyne, Rea Farms and others have incorporated multifamily into their development plans.

Harris explained how LMC selects potential development sites: “We’ve been focused on the Uptown, South End and South Charlotte submarkets within Charlotte’s ‘wealth wedge’ (SouthPark, Ballantyne, Waverly). We have pursued numerous sites in these submarkets, but competition is fierce for land at prices where the economics make sense.”

Permits for new housing issued from 2008 to October 2019. Blue indicates single family homes. Purple, townhomes. Green, multifamily. Source: Mecklenburg Permits Issued Daily, Author: Nathan Griffin

Rent Prices and Affordability

Most of the new multifamily development targets the high-end market. In some cases, aging housing stock is demolished to make way for luxury units, eating away at the naturally occurring affordable housing.

Area rent prices, construction costs, and land values all determine a site’s feasibility. The most desirable areas, where rents are high, are attracting the most development. As input costs rise, delivering a more affordable product becomes increasingly difficult.

At over $1,400 per month, Charlotte has the highest median rent list prices of all the municipalities in Mecklenburg, according to Zillow. Matthews, Cornelius and Huntersville exceed $1,200 per month. Countywide, median rents grew by 65 percent between 2011 and 2019. These rising rents, which correlate with the region’s rising home prices, further stretch the budgets of families in the area who can’t afford to buy.

While median rent prices are telling, the distribution of rents is also concerning. The State of Housing report finds that, in the region, 45 percent of renters are cost burdened, defined as spending more than 30 percent of gross income on housing costs. Additionally, 80,000 households earn $15,000 per year or less. For those households, finding affordable market rate housing is unlikely.

What can be done to encourage housing development that is affordable to a more diverse range of incomes?

Allowing higher density in more areas might help slow down price growth. As of 2015, 61 percent of the land area in Charlotte was zoned for single family homes, 7 percent was zoned for multifamily, and only 9 percent was zoned for multiple uses. Now, some Charlotte City planners are discussing eliminating single-family zoning, believing that relaxing restrictions will open up more areas for multifamily and mixed use. This, in turn, might help to add supply and lower housing costs.

Other options might be to relax codes that add unnecessary construction costs. For instance, many areas dictate the number of parking spaces required. Each parking space adds cost, especially if the parking is underground or in a specially constructed deck. Requirements for ground floor retail add cost as well. While these retail spaces can be important for adding interest and walkability to the streetscape, requiring them in the wrong places adds cost, especially if they sit vacant.

Market based solutions alone will not likely solve the problem. The City of Charlotte is taking steps toward increasing access to affordable housing. Voters recently approved increasing the tow-year allocation for the Housing Trust Fund, which subsidizes affordable housing, to $50 million.

In the private sector, the Foundation For The Carolinas, through its Charlotte Housing Opportunity Investment Fund has raised more than $50 million in additional funding for affordable housing.

While this is a significant investment, there is still a major deficit of housing that is affordable. The question is if voters will approve higher taxes to help fund these programs.

The Urban Institute Strategies for Affordable Housing Development report points to 12 policies that could help add more affordable housing in the long run. Some of the policy recommendations include: grants for affordable housing, rebates on permit fees to incentivize affordable housing, special zoning districts and community land trusts. The takeaway being that there are many tools available but there is no one size fits all approach to affordable housing.

For some, rising rent means eviction.

In Mecklenburg, for fiscal year 2018/2019, 32,724 eviction cases were filed. Of those cases, 18,195 were granted in whole. Year over year evictions grew by 7 percent, even as the unemployment rate has been falling. The recent rise reverses the trend of years of declining evictions since the 2008 financial crisis. The effects of eviction are profound, from stress and anxiety of trying to find a new place to live, to the struggle to find new housing with an eviction record.

Though there are many causes of eviction, both the increase in evictions and the high number of those being evicted points to a trend of rising rent putting increasing financial pressure on households, especially those at the lowest income levels. Access to affordable housing is one of the necessary ingredients for improving economic opportunity and mobility in the city.

In the near term, as long as the economy and population continues to grow, apartment construction will likely continue at a rapid pace and affordable housing will continue to be a central issue. But, as millennials grow older, pay down debt and start families, they may prefer to own instead of rent. If homeownership rates begin to rise again, it might mean that single family housing could make a comeback.

Nathan Griffin earned a master’s degree in economics from UNC Charlotte in 2018 and a bachelor’s degree in business management from Pfeiffer University in 2016. He works as a project developer at Trane where is involved in commercial construction projects.

Nathan Griffin