As society changes, so does rentership

Just like F. Scott Fitzgerald’s character Nick Carraway, who went “East, permanently, I thought,” in 1922 in The Great Gatsby, people today are on the move and looking for a place to rent. Fitzgerald’s Carraway – a recent college graduate, returning war veteran and single – hopes to start his career in the bond business. Sound familiar?

|

Multifamily matters This week: Who are today’s renters? A look at the changing demographics of housing. Last week: A look at the apartment boom in the Charlotte region. (click here) |

For many reasons, more Americans are renting their homes today compared to recent years. How does that reality square with long-held perceptions about homeowners versus renters? In Charlotte, for instance, a proposed change to the zoning ordinance to allow more duplexes in single-family home neighborhoods has been controversial. Some opponents say they fear duplexes would bring more rental properties to their neighborhoods. (See related PlanCharlotte article here).

This controversy raises the question: Who are renters today?

Today’s renters are probably wealthier, better educated and more likely to be married than the image many people carry in their minds. And their numbers are growing rapidly in Charlotte and nationally, a result of demographic and lifestyle changes and the shakeout of the housing bust of the past four years.

Hunter and Rebecca Jones, in their early 30s, are part of that growing trend of current or former homeowners who are now renters. They’ve owned two homes in the past but were caught “in a cycle of layoffs and rehires in my job as a construction supervisor,” says Hunter Jones. “So, I decided to go back to college and re-enter the job market later. Now we go wherever Rebecca can find work. We sold our house and moved from Alabama to Florida about 18 months ago.”

Rebecca Jones, who works in marketing and sales, thought a promotion would be a great opportunity, despite requiring a 1,000-mile move to Michigan. “But unexpectedly, the company laid off over 300 people, including me, just three months after our second relocation,” she said. “After six months of looking, I’m starting a new job and we are moving again.”

Their story is not unusual. “Once an owner, always an owner,” doesn’t hold true anymore, if it ever did. So, today’s renters may well be current or former homeowners themselves. According to the American Housing Survey, about 25 percent of all married homeowners who moved between 2007 and 2009 switched to renting. Rates were substantially higher for unmarried homeowners. More than half who moved during the same period became renters. Statistics from the National Longitudinal Survey of Youth (included in the Harvard study linked below) show that 45 percent of first-time buyers in the 1980s and 1990s returned to renting or moved in with parents or others.

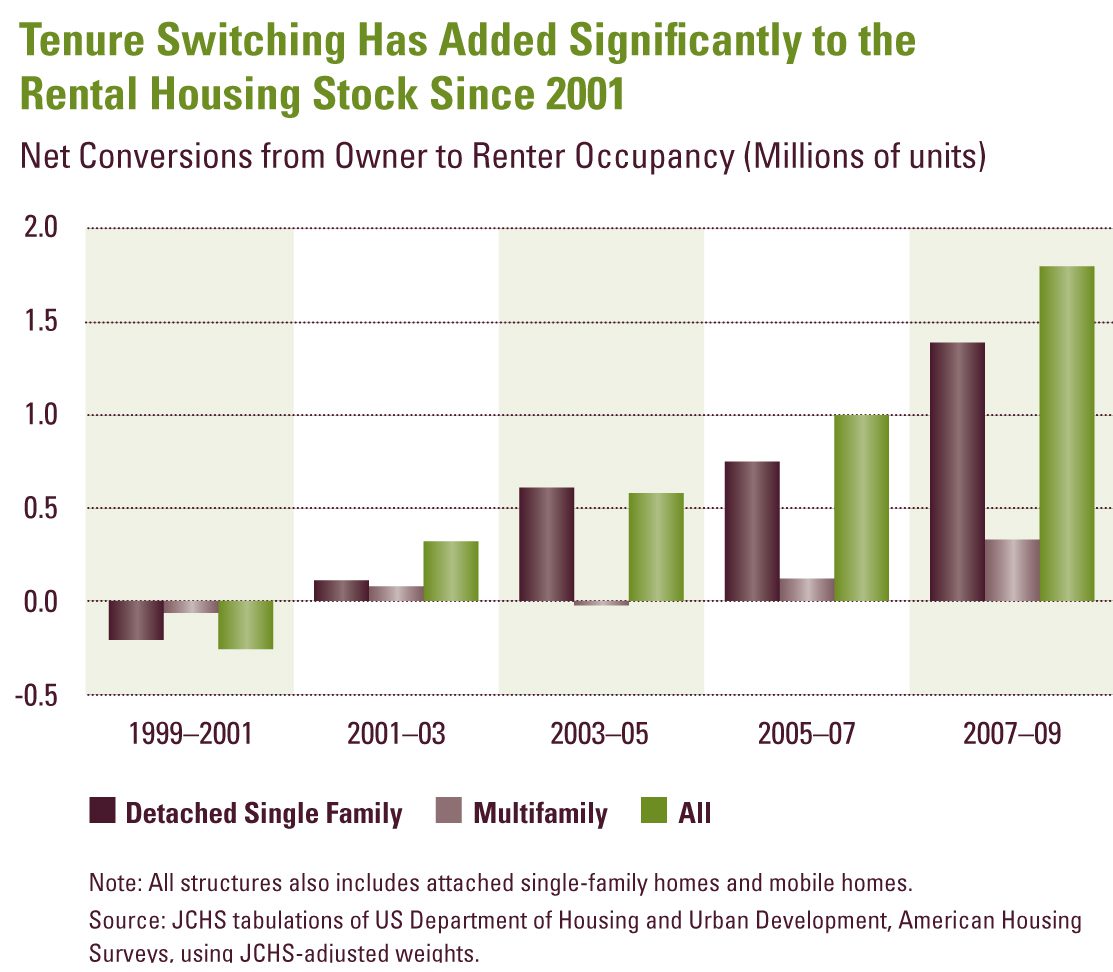

Harvard University’s 2012 annual report, “State of the Nation’s Housing,” prepared by its Joint Center for Housing Studies, says the decade of the 2000s had the largest surge of renters in the post-World War II era – an increase of 5.1 million, with 1 million of them in 2010-2011. That was the largest annual increase since the early 1980s. As shown in the chart above, the pace of net property conversions from owner to renter tripled in 2005-7 (relative to 2001-3), then nearly doubled again from 2007-9 to 1.9 million units. Single-family detached homes accounted for three of every four conversions to rentals in 2007-9.

Another big change came in renter demographics. “Households earning more than $75,000 contributed nearly a fifth of the increase in renters in 2006-11,” the report says. Married couples accounted for 50 percent of the growth in renter households in the past five years, the report says, although in 2011 they were still only 36 percent of all renters.

In Charlotte, the rental market is red hot, and multifamily housing construction is booming. About 3,100 units are under construction with 8,000 more planned, according to REBusiness Online, a commercial real estate newsletter. As one of the fastest-growing U.S. metro areas, Charlotte gained an average of 90 residents a day in the last year, says a third-quarter 2012 apartment research market report by Marcus & Millichap, a real estate investment company.

“The young, educated, single-person household is about 28 percent of our market and growing,” said Ken Szymanski, executive director of the Greater Charlotte Apartment Association. “The international population of about 100,000 people is another big part of Charlotte-Mecklenburg renters. Around half of those are multifamily occupants,” he said. “Many people choose renting because they don’t see permanent housing choices, like homeownership, attractive anymore.” (Jan. 9, 2013 correction: An earlier version of this article incorrectly quoted Szymanski saying the international community was half of all multifamily occupants.)

As the Charlotte job market recovers more people will continue moving to the area. Many newcomers will be echo-boomers (those under 35 in 2020), who are typically more attracted to urban communities. Meanwhile, according to the Marcus & Millichap report, 16 percent of homes in Charlotte’s market remain underwater, meaning they are worth less than is owed on them. A few of these homeowners may default and turn back to renting, while potential buyers wait until the housing market stabilizes. All those things mean more renters.

Record-low 5 percent vacancy rates are expected to keep overall rental demand up. That, in turn, is driving up rental rates. For the first quarter of this year, the real estate data firm Reis Inc. ranked Charlotte second nationally for the steepest gains in multifamily effective rents. Real Data reports the average apartment rent in Charlotte is $839.

Many factors contribute to the rise in renters. In mid-September the number of mortgage loans funded nationally hit a 16-year low, down 64 percent from the 2006 peak, the Wall Street Journal reported. Among the reasons:

Record high foreclosure rates continue, with more than 2 million homes in some stage of foreclosure in early 2012. And buying a home isn’t so easy anymore. Getting credit is harder. Higher down payments are required, typically 10 to 25 percent for conventional mortgages. Higher-risk loans have been eliminated.

For younger potential buyers, student loan debt is a big problem. According to a 2010 Barron’s article, in 2007-2008, 65.6 percent of those with bachelor’s degrees averaged $23,300 in student debt.

In addition, average income is down nationally. So is total employment. For many Americans, home ownership is less appealing, and many now choose to rent. Not surprisingly, homeownership rates in all age categories (except seniors) declined over 2000-2010. Recently released U.S. Census Bureau figures put homeownership at 64.6 percent in 2011, around the 1993-94 level.

All that has changed the makeup of those entering the rental market.

It’s no secret that most of us will be renters at some time in our lives. Although more than 80 percent of married couples own homes, families often rent at key transitional times, such as moving for a new job or empty-nesting.

In today’s economy many families find themselves with a house to sell in one location after moving to a new one. “Our Charlotte-area apartment communities are 99 percent occupied – and this is usually our slow time,” says a Charlotte-area property manager for a large company with more than 10,000 apartments and townhomes in North Carolina and Virginia. (She agreed to be interviewed on the condition her name not be used.) “Other things besides buying a home have become more important to people – like mobility, budget, and upkeep. They don’t view rent as throwing money away, but rather as a way to simplify their lives.”

Also on the rise are households with spouses working in different locations. Consider this couple, who didn’t want their last names used. Barbara and her husband live in Ohio, but she is a professor at a state university in Texas. “I’ve been flying between our home and an apartment I keep in Texas for the past seven years,” she said at a recent neighborhood barbeque. “It’s not exactly what we expected to happen; it’s just what we’ve had to do.”

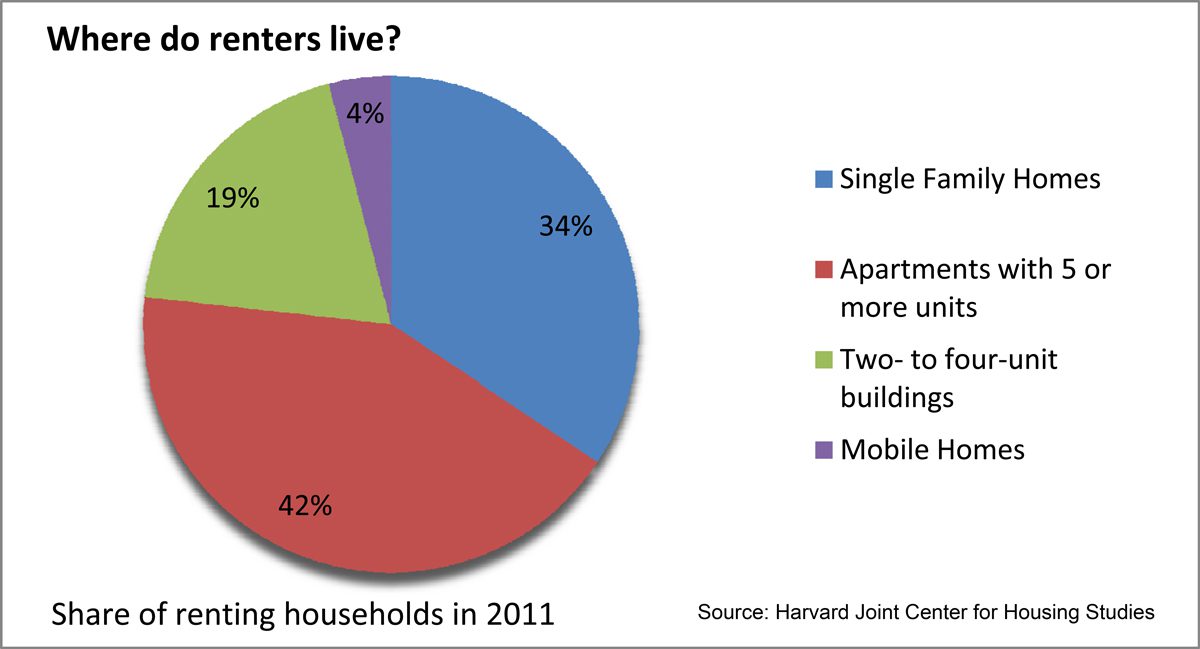

Don’t assume all renters are young, minority and low-income, either. “Half of all renters are over age 40 and a majority (65 percent) are white,” says the Harvard report. Yes, renters tend to be younger (median age 40, compared to homeowners’ 53). Renter households are typically smaller, with 35 percent single and another 16 percent headed by single parents.

Renters as a group tend to have lower incomes, regardless of age, in part because so many more are single-income households.

Despite changes in the renting population, some neighborhoods are wary of too much rental housing, especially low-income housing.

Susan Lindsay, an East Charlotte homeowner, has seen its effects. “Our first- and second-ring suburbs are aging, along with their homeowners. As people passed away or moved out, many of the properties became rentals,” she said. Many of those became permanent rentals, often used for Section 8 subsidized housing, a federal program that gives rent vouchers to low-income families.

“This has led to a destabilization of our neighborhoods,” Lindsay said. “Many landlords have not maintained their properties or invested in needed upkeep, and some will only rent to those with Section 8 vouchers because they guarantee income.”

Lindsay has also seen negative impacts on nearby shopping centers. “In areas with large pockets of low-income residents, there is not enough disposable income to support commercial development, and the neighborhood suffers.”

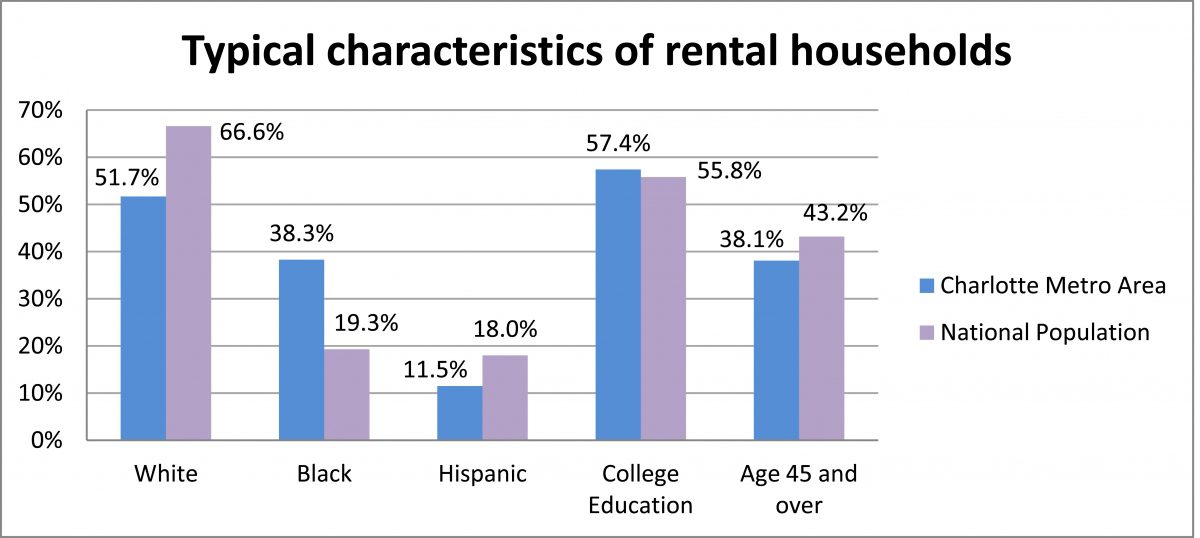

In the Charlotte metro area, the rental population is more racially diverse but otherwise not dissimilar from the national picture: 51 percent of local renters are white, 38.1 percent are older than 45, and 57.4 have some college education.

Nationally, growth in renter households is expected to continue over the next 10 years. The Wall Street Journal’s Daniel Gross calls the move to rentership, “a sign of a system adapting – albeit too slowly – to new realities.” In a post-bust economy, renting is seen as “a much more economically efficient way to pay for housing,” writes Gross. In today’s dynamic economy, Americans need mobility, something homeownership can get in the way of.

What about those old real-estate dreams that view owning a home as the symbol of success? Hunter Jones’ conclusion: “The new American Dream is having a job – not owning a house.”