Facing more investor purchases, Charlotte considers tweaking housing programs

As investors — including Wall Street-backed single-family rental companies — buy more homes across Charlotte and Mecklenburg County, the city of Charlotte is considering changes to some of its homeownership assistance programs.

Buyers in the region face record-high prices and record-low inventory. In January, the median sales price in the Charlotte region was almost $350,000 up 22.7% from the previous year, while just a two-week supply of homes were on the market, according to the Canopy Realtor Association. That’s made it harder for low-income buyers to compete, even with the aid of programs from the city of Charlotte such as down payment assistance loans.

“You’ve got lots of price escalation going on here, and just a very, very restrictive buying market,” said Warren Wooten, a Charlotte housing official. Charlotte City Council’s Great Neighborhoods Committee reviewed the down payment assistance program’s challenges and possible changes at a meeting Monday.

HouseCharlotte, the city’s main down payment assistance program, is administered by DreamKey Partners. Over the past 20 years, the program has invested $51 million in down payment assistance, helping 6,779 lower-income buyers. Recipients can receive up to $17,000, depending on their income, which they can use for a down payment or to buy down a loan’s interest rate. If the borrower stays in the house for 15 years, the loan is converted into a grant and forgiven.

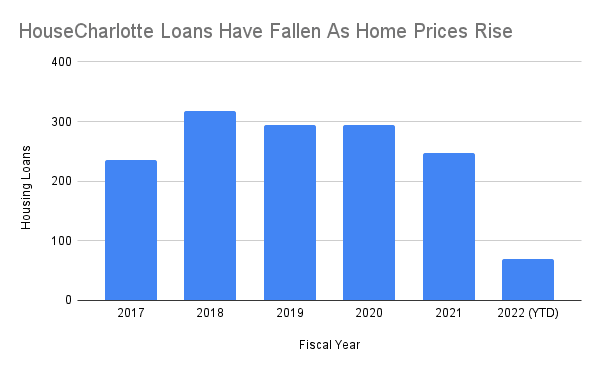

Over the past five fiscal years, the HouseCharlotte program has made between 235 and 317 loans. But at the halfway point of this fiscal year, the program had only made 69 loans, putting it on pace for barefly half the average of recent years. Housing officials attributed that drop-off to the difficulty of finding lower-priced homes, as the median single-family house now costs well over the program’s $300,000 price limit for existing homes.

“We’re dealing with a huge, market-related problem,” said Wooten.

One factor City Council members pointed to: The proliferation of single-family rental companies like Tricon, American Homes 4 Rent and FirstKey Homes, which have bought thousands of houses across the region over the past decade. An Urban Institute analysis last year found these large, Wall Street-backed companies owned more than 11,000 houses in Mecklenburg County, 4.3% of the total, making them the largest single landlords in what has traditionally been a fragmented, mom-and-pop business.

[Wall Street-backed landlords now own more than 11,000 single-family homes in Charlotte]

A recent Washington Post story estimated that investors (big and small) bought 25% of all homes purchased last year in Charlotte.

“It’s hard for the average person to compete with a corporation,” said council member Renee Johnson. “Something has to change. People are being priced out of this city because of this corporate buying.”

City staff recommended changes to the down payment assistance program, including:

- Attaching covenants to loans for properties that would require them to be used as a primary residence and be sold only to other owner-occupiers.

- Granting the city the right of first refusal for homes purchased with down payment assistance, so the city could buy the houses and resell them to other low-income residents.

- Including “shared equity” for home loans participating in the assistance program. That would mean the city not only gets repaid the balance of the loan assistance if a house is sold before the loan converts to a grant, but would also share in some of the profits. That would give the city more money to fund the program going forward.

- Extending the date of loan forgiveness from 15 years to 30, potentially increasing the amount of money available in the program to assist more homeowners.

Some of those measures, especially the covenants and right of first refusal, would be squarely aimed at preventing large investors from buying up affordable properties. Wooten also said the program needs more funding and higher price limits to keep up with the market.

Johnson asked if the city could do more to directly restrict investors from buying single-family homes as rentals.

“Is it possible that we can help HOAs strengthen their restrictive covenants?” she asked. “Could we provide some funds to help them modify their deed restrictions?”

Wooten said the city hasn’t looked at the issue “holistically” yet, but that officials can consult legal staff to explore more options.

Down payment assistance is a relatively small part of Charlotte’s housing program, with $231,000 budgeted for the HouseCharlotte program in fiscal 2022. The biggest program by far is the city’s Housing

Trust Fund, which subsidizes mainly new affordable apartment construction. The trust fund is funded by a $50 million bond issue every two years.

“Fifty million is just not enough to do anything anymore,” said council member Malcolm Graham, who wondered if the bonds could be doubled to $100 million in 2024. There appears to be appetite on council

to at least explore such a step.

“We just need so much more,” said Johnson.