Charlotte suburbs grow faster as developers seek cheap land

In 2018, Mecklenburg County issued over 5,000 permits for single family housing. That’s more than double the next fastest growing county: York, in South Carolina. But while Mecklenburg is still a major contributor to new housing in the region, it’s making up a smaller proportion of permits issued and now only accounts for about one third of all single-family permits.

Development has been sprawling. Places that were once rural now seem urban. Take Fort Mill, S.C., whose population, according to the American Community Survey, has nearly doubled since 2010. Many small towns have grown into bustling suburbs as developers search for large tracts of land to build residential communities. As the population grows, low-cost land and high volume are necessary to meet the regions demand for single family housing.

But that trend raises more questions. What factors do builders and developers consider when choosing a site? Why is development shifting further outside of Charlotte? Ultimately, will buyers continue to settle for longer commute times in order to find housing they can afford?

Trends in Permits – 1990 to 2018

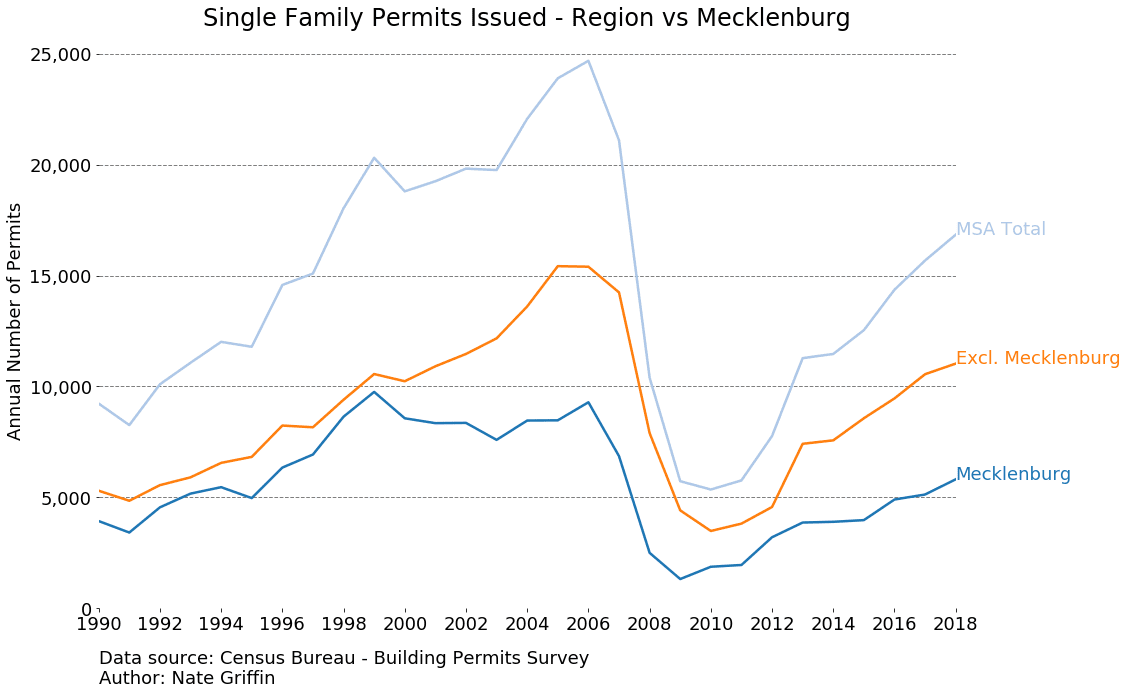

The Census Bureau’s Building Permits Survey tracks residential permits from every municipality in the U.S. Yearly data is available from 1990 to 2018. Throughout the 90s, Mecklenburg County alone kept pace with the 11 other counties in the Charlotte Metropolitan Statistical Area (MSA) combined.

In 1998, new construction in the surrounding counties began to diverge from Mecklenburg, which peaked at just under 10,000 permits for the year. New home permits continued to increase in the outlying counties, eventually producing over 15,000 total homes per year in 2005. Since then, Mecklenburg permit growth has trailed the surrounding counties. Residential construction is still happening in Charlotte, but multifamily and townhome development has taken up a greater share of the residential market.

In 2006, new home permits in the region hit an all-time high at nearly 25,000 per year. This was fueled by a combination of high price growth as well as optimism about the future of the economy. Following the financial crisis of 2008, declining prices, fear, and oversupply meant that builders were either too wary to construct more homes, or were unable to sell off their existing inventory.

From peak to trough, annual regional housing permits issued fell almost 80 percent, to just 5,300 in 2010. Many builders pulled out of the market, construction jobs vanished, wages fell and unemployment rose. A decade later, neither Charlotte or the region as a whole have reached their pre-recession peaks for new home construction.

Why has single family home construction taken so long to recover? Could it be due to higher lending standards and changes in preferences, or is it because large tracts of vacant land are increasingly harder to find?

Trends in surrounding counties

The figure above shows the number of new home permits by year for the fastest six growing counties (excluding Mecklenburg). Before 2007, Union County was one of the fastest growing counties in the US. In 2018, it issued less than half the permits than it did at its peak in 2005.

Lancaster County has historically ranked near the bottom of counties in the region for new home growth. In 2013, however, development surged and caught up with Gaston County. This is primarily due to the growth of Indian Land, S.C. which sits at the tip of the county, just below the state line. This area has seen an influx in development spilling out of Ballantyne.

Counties are fighting hard to attract new development. Gaston County approved a proposed plan to connect future light rail service to downtown Gastonia, and light rail could also extend to Union County, Cabarrus County and Pineville (though it remains to be seen who will pay for the project). Indian Trail is asking for feedback from it’s residence on extending light rail to it’s downtown. Iredell will likely benefit from the much contested I-77 expansion. The Monroe Expressway opened this year in Union County, which is likely to draw more development. All of these infrastructure projects will allow more commuters to access neighborhoods further away from Mecklenburg.

Land

Why are builders looking for land so far outside of Charlotte? Scott Herr, VP of Land for M/I Homes in Charlotte explained the factors that builders consider before investing in a new development.

“The most important considerations for us are the proximity to employment centers, the quality of the school districts, the receptiveness of local jurisdictions to quality housing projects, and the presence of critical infrastructure, including water, sewer, and roads,” he said. “Those are the key ingredients. ”

Herr adds, “It’s a supply/demand analysis to understand if it will be worth the risk. We need to know if we’ll realize a positive return out of the deal in a timely way to justify a very substantive investment in a new community.”

Finding available tracts of land in Mecklenburg that meet those requirements is increasingly difficult. According to the Charlotte-Mecklenburg Planning Board, as of 2018 only 18 percent of land in Mecklenburg was classified as vacant.

Herr confirms that vacant land is a motivation for suburban growth.

“Mecklenburg County is largely built out. There are exceptions to that in northwestern areas of the county and some eastern parts, but in general, there aren’t a lot of places to build 200 to 400 homes,” he said.“ The county is seeing a lot of exciting infill development. There is just more available land in surrounding counties.”

Why do builders need such large tracts of land? Chad Lloyd, Director of Land Acquisition for M/I Homes of Charlotte describes the challenges.

“It’s about economies of scale. Builders can spread their fixed infrastructure and underlying land costs better with larger tracts. That translates to home pricing landing in a more attainable range for a larger portion of the market. We can be more creative with the land plan as well (e.g. open space, amenities),” he said.

Construction, similar to manufacturing, needs scale to be efficient. Tract builders gain cost advantages building a limited number of floor plans over many acres of graded land. Building in bulk means buying in bulk — yielding savings on everything from lumber to roofing materials.

A repetitive building process means framers, drywallers, plumbers, electricians and other trades can perform their installation quickly and efficiently without having to waste time searching through design documents.

By contrast, in denser urban areas, there is little vacant land and fewer contiguous lots. Building custom houses on single plots of land, especially if structures need to be demolished first, adds time, complexity and expense.

The central neighborhoods like South End, Myers Park, and Dilworth contain some of the most expensive real estate in the county. Here, very little land is considered vacant. To produce homes at a lower price point, builders might replace existing single family homes with townhomes or apartments.

Relaxing zoning regulations might encourage higher density development in some areas, helping to increase inventory, but likely changing neighborhood character in the process.

Some large parcels of land remain near Huntersville and Mint Hill, but few large parcels of land still exist within Mecklenburg, and many of the remaining sites already have master planned communities in construction or in the design process. For example, The River District, a 1,400 acre, mostly wooded site between the Catawba River and Charlotte’s airport is under development by Crescent Communities and Lincoln Harris.

Price

Source: zillow.com/research

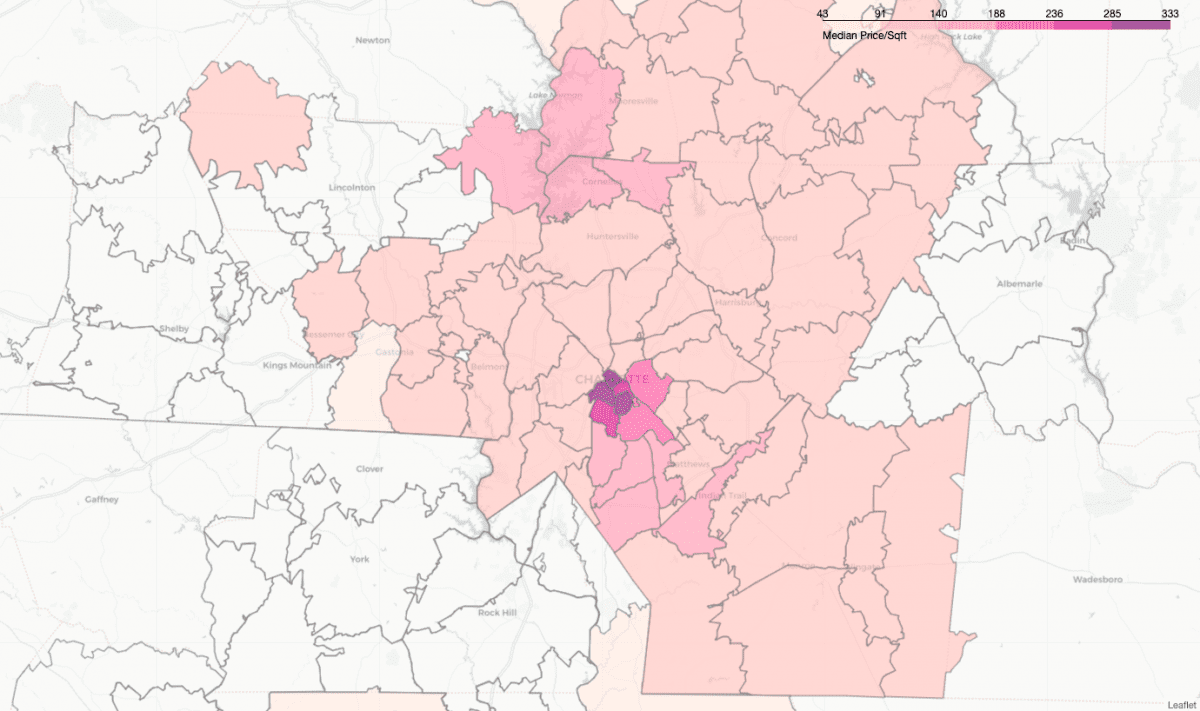

Zillow provides data on home prices. The map above shows the median home price per square foot for each zip code in the Charlotte area for August 2019. Zip codes without data are not shaded. At $333 dollars/sq. ft, 28207 (which encompases part of the Myers Park market) commands the highest price — higher than even uptown at $298/sq. ft.

It all comes down to price. Prices are highest in the central areas, where demand is high and vacant land is scarce. Because of the higher land values and construction costs, to be profitable on a project, builders construct either high end or high density infill. These economic factors are causing naturally occurring affordable housing in popular areas to vanish.

While outlying areas typically sell at lower prices, builders can take advantage of construction efficiencies and lower land values to keep costs low and volumes high. So long as these trends continue, it’s likely that sprawling single family development will continue into the suburban, outlying counties while higher density and multifamily projects increase in the close-in neighborhoods.

Nathan Griffin earned a masters degree in economics from UNC Charlotte in 2018 and a bachelors degree in business management from Pfeiffer University in 2016. He works as a project developer at Trane where is involved in commercial construction projects.

Nathan Griffin