Corporate landlords include exclusionary language in rental housing listings

A new study of online rental housing advertisements in Charlotte found that corporate landlords are more likely to include potentially exclusionary language in their listings, and those listings are largely concentrated in minority communities.

That’s one of the key results from a study by UNC Charlotte scholars Providence Adu, a PhD Student in the Department of Geography and Earth Sciences and Research Assistant at the UNC Charlotte Urban Institute, and Dr. Elizabeth Delmelle, an associate professor in the Department of Geography and Earth Sciences. Their article, “Spatial Variations in Exclusionary Criteria from Online Rental Advertisements,” was published in June in The Professional Geographer.

Although the Fair Housing Act prohibits discrimination based on race, sex and other traits, landlords are allowed to screen potential tenants for things like minimum credit scores, income, criminal and eviction history. Since many of those factors correlate to race, discriminatory housing patterns can consist and reinforce residential segregation. These screening terms can also serve to restrict housing options for individuals with “discredited” backgrounds

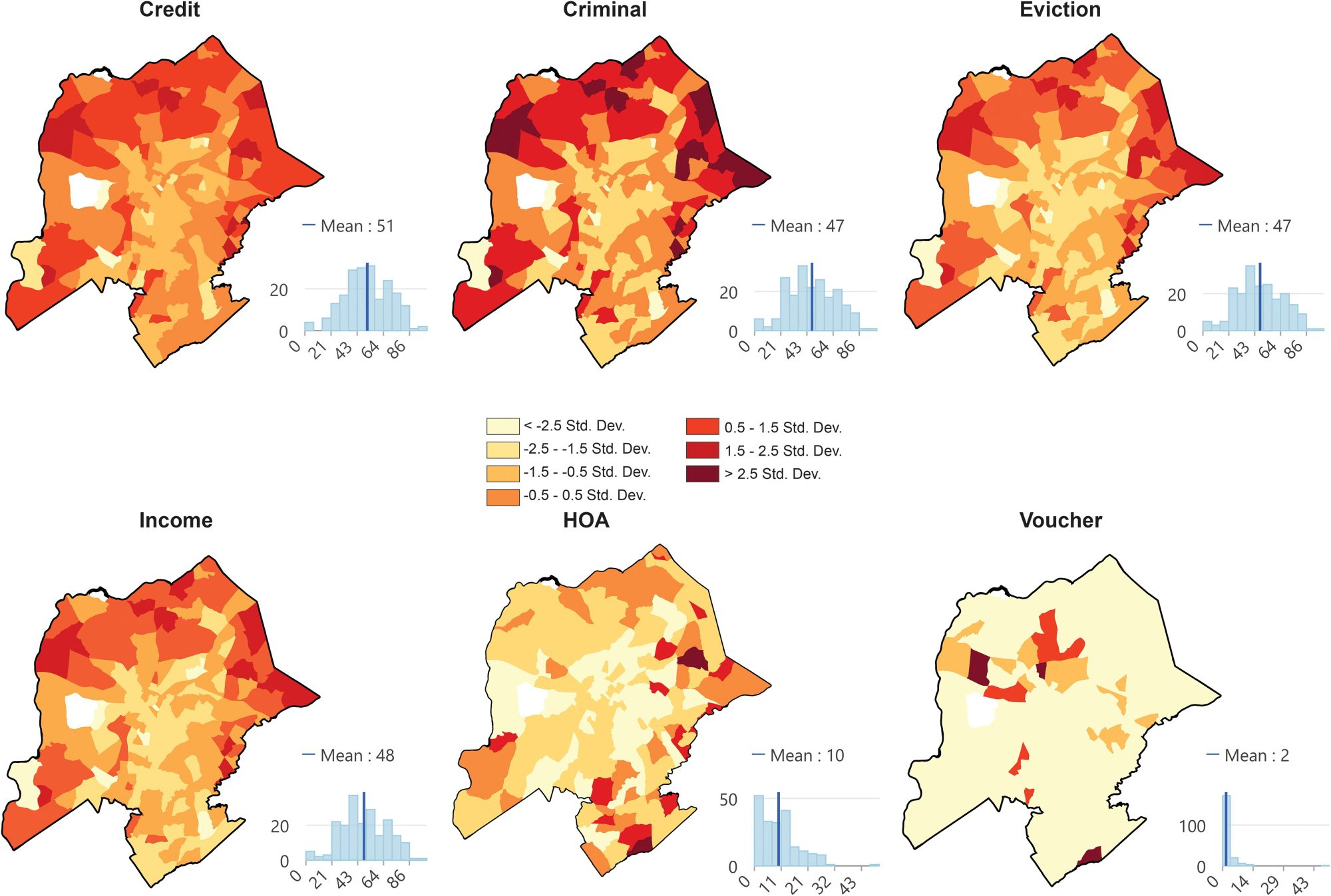

Using natural language processing and geospatial modeling techniques, Adu and Delmelle examined 8,616 rental listings in Charlotte from March 2021 through November 2021. They mapped the listings to Census tracts in Charlotte, and examined how many of them contained terms such as “credit scores, credit report, credit history, housing vouchers, Section 8, proof of income, [or] income-to-debt ratio.” They also examined how the usage of these terms varies by neighborhood race and income.

Their findings include:

- “Minimum credit scores, no criminal backgrounds, no prior evictions, and minimum income requirements are the most listed exclusionary criteria. These were most common in poorer, minority neighborhoods of the outer ring of the city, which represents some of the oldest suburban or single-family neighborhoods within the broader metropolitan area.” Half of all listings included minimum credit scores. “Overall, we find criminal backgrounds, credit scores, housing vouchers, evictions, and minimum income restrictions to be less common in Whiter neighborhoods and therefore more pervasive in minority neighborhoods.”

Spatial distribution of each exclusionary criterion in Charlotte, North Carolina. Note: HOA = homeowners association. Adu/Delmelle

- Corporate landlords — companies such as American Homes 4 Rent and Tricon, that have bought thousands of single-family homes in Charlotte since the Great Recession — “systematically listed nearly all exclusionary criteria (except for HOA and housing voucher) in every listing.” Their holdings were more concentrated in minority neighborhoods: “Because the share of holdings by these entities was larger in more minority and lower income neighborhoods—an artifact of the housing market crash and disparities in predatory lending—the concentration of these exclusionary criteria mentioned in listings followed.”

- Housing vouchers (commonly referred to as Section 8) were actually the least-mentioned exclusionary criteria, appearing in only 1.5% of listings. But, the researchers noted: “The population that relies on vouchers, however, will typically be excluded based on minimum income restrictions alone.”

- There were significant differences between the two platforms the researchers examined, Zillow and Craigslist. Zillow featured all of the corporate landlord listings (none advertised on Craigslist) and listings on Zillow systematically included more exclusionary criteria. Craigslist featured mostly small and independent landlords (the typical “mom and pop” owner), and exclusionary criteria varied spatially. On Craigslist, housing voucher restrictions were more common in higher-income neighborhoods and prior eviction restrictions were more common in Whiter neighborhoods.

Ultimately, the researchers concluded that: “the reliance on these legally observable and seemingly objective traits for screening potential tenants enables larger, often out-of-state landlords to skirt fair housing laws, but by using criteria that are largely correlated with race, they ultimately perpetuate long-standing patterns of inequity and segregation.”

You can read the full paper here (subscription required — many academic institutions provide access, including UNC Charlotte).

Background from 2021: Wall Street-backed landlords now own more than 11,000 single-family homes in Charlotte