The decline (and rise?) of Carolina manufacturing

After decades of decline, manufacturing jobs across the country have seen a modest uptick. This long period of industry restructuring has left a strikingly different geography of manufacturing in the Carolinas; we still make furniture and textiles, but that’s no longer the whole story. New industries have taken root. Many offer higher wages than the traditional manufacturing jobs in the region, as well as potential for growth.

How much manufacturing? How well does it pay?

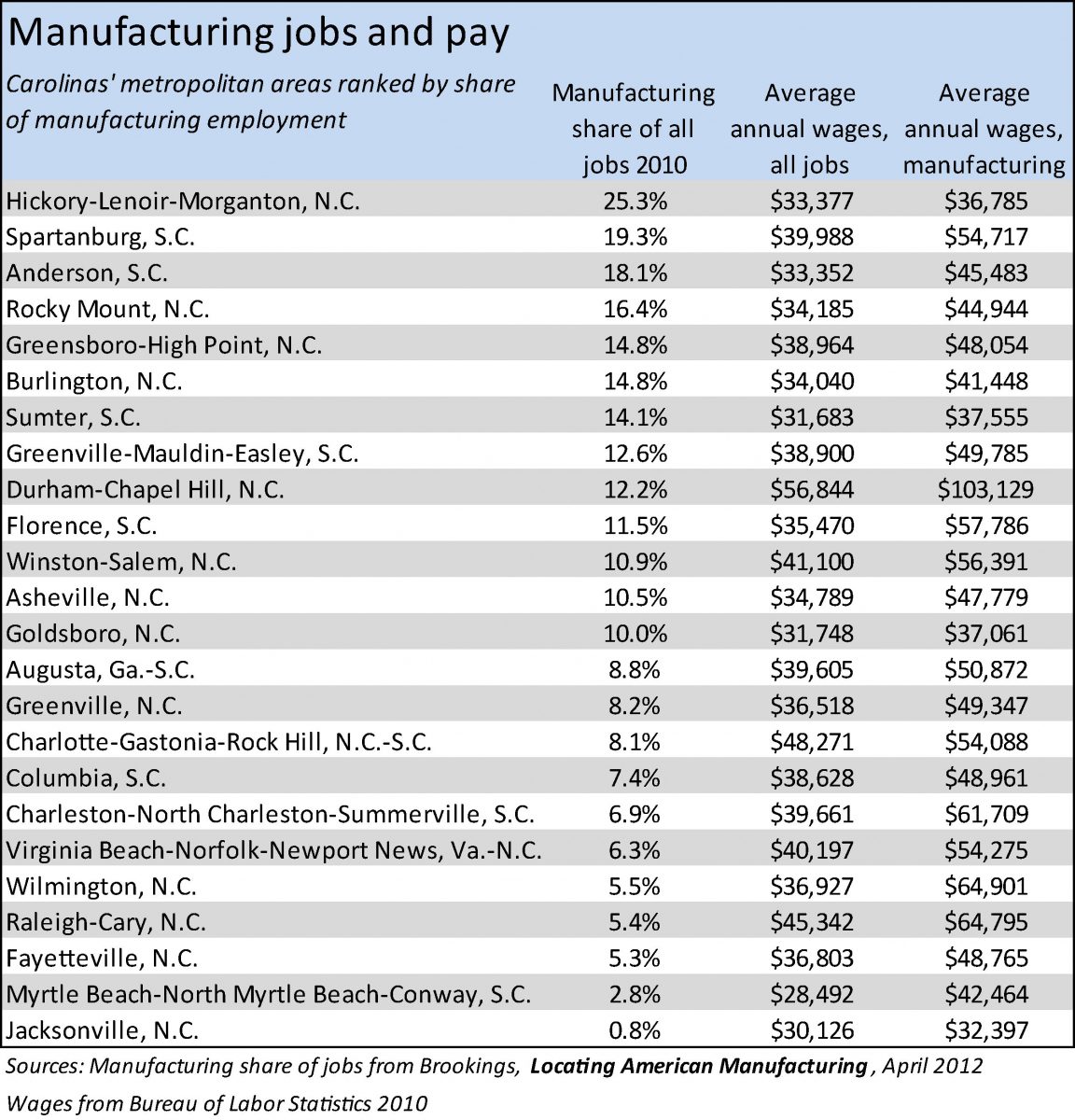

Carolina metros vary widely in both their degree of manufacturing employment and the wages those jobs pay. After 30 years of industrial job loss in the U.S., 40 percent of the Carolinas metro areas are below the national average in manufacturing employment (8.5 percent in 2010).* The table below shows the Metropolitan Statistical Areas in the two states, ranked by the proportion of manufacturing jobs among all the jobs in that MSA. It also shows each metro area’s average annual wages for all jobs, and for manufacturing jobs.

The Hickory-Lenoir-Morganton metro has the highest percentage of employees in the manufacturing sector, 25.3 percent. It is almost three times as “specialized” in manufacturing as the average national percentage. “Specialization” is a way to compare one metro’s share of jobs in a sector to the national share of employment in that sector (often called the location quotient). By this measure, the Hickory MSA is the most specialized in manufacturing in the Carolinas and ranks eighth in manufacturing specialization among all U.S. metros.

In many places in the country, this high concentration in manufacturing would mean higher than average wages. Nationally, average manufacturing wages are higher than the average wage for all jobs. According to the Bureau of Labor Statistics, the U.S. average wage for all jobs was $46,751 in 2010. The U.S. average wage for manufacturing jobs in 2010 was $57,526. Among Carolina metros, however, several have average manufacturing wages not only below the national manufacturing average but below the U.S. average for all jobs: Anderson (S.C.), Burlington, Goldsboro, Hickory, Jacksonville, Myrtle Beach (S.C.), Rocky Mount and Sumter (S.C.).

The eye-popping average manufacturing wage in Durham-Chapel Hill is a stark contrast. The Durham metro ranks second in the nation in manufacturing wages, after San Jose-Sunnyvale-Santa Clara, Calif. (Brookings). This high manufacturing wage contributes to the Durham metro’s rank as No.1 in the two Carolinas in average wages for all jobs. The two largest Carolina metros rank just behind Durham in average wages for all workers: Charlotte-Gastonia-Rock Hill at No. 2, Raleigh-Cary No. 3. The Charlotte metro, however, ranks only ninth in the Carolinas in average manufacturing wage.

The specialization index mentioned above can also be used to measure sub-sectors of manufacturing. The maps below show index values, with a circle representing the specialization index. The bigger the circle, the more specialized the metro is for that particular manufacturing sector. According to the Brookings Institution, “a metropolitan area is considered to be strongly specialized in a manufacturing industry if it has an index of 1.05 or higher. Index values greater than 1.50 indicate very strong specializations, and values greater than 1.90 indicate a highly specialized metro area.”* From a national perspective, many Carolina metros are highly specialized in some manufacturing sectors. Hickory’s furniture industry is one example.

Traditional/historic Carolina manufacturing by metro area*

(select category from drop-down menu to see specialization)

The Southeast and the Carolinas are still centers of U.S. textile and furniture production. Hickory’s high specialization in furniture is clear in the furniture sector map, above. Using the drop-down box to switch to the textile mill map shows a more geographically dispersed set of textile-specialized metros. MSAs along the Interstate 85 corridor from Anderson, S.C., to Burlington show the highest values, but the textile industry still shows up as a manufacturing focus in nearly every other Carolina metro. (Myrtle Beach and Jacksonville did not have manufacturing specialization in any industry.)

The tobacco map (classified as beverage and tobacco) shows a smaller remnant of the tobacco industry’s imprint centered on Winston-Salem. Other sectors with high specialization in the Carolinas include apparel and textile mill products (not mapped). All those sectors have significantly lower wages than average for U.S. manufacturing jobs, and even lower average wages than the average wage for all U.S. jobs.

The Carolinas’ traditional manufacturing bases in textiles and furniture have the dual problems of low wages and continuing employment decline, even in the recent manufacturing turnaround. By identifying new and emerging manufacturing sectors, states and local communities have the opportunity to build on those strengths. The next set of maps (below) highlight some newer areas of industrial specialization.

Newer/emerging manufacturing sectors by metro area*

Of the 24 Carolina MSAs, 11 have a specialization in production of electrical equipment and appliances. Although historically rooted in furniture and textile mills, Hickory has become the most specialized in this sector in the Carolinas, at 8.3 times the average for the whole country and ranking No. 5 nationally. Fiber optic manufacturing has played an important role in Hickory in this sector. The Rocky Mount metro is not far behind, at 6.2 times more specialized than the national average. The electrical equipment and appliance production industry had an average annual wage of $57,397 nationally in 2010, more than $10,000 higher than the average U.S. wage. This strong specialization may offer new opportunities that metro areas like Hickory can build on, particularly since it has the highest percentage of manufacturing employment among Carolina MSAs – not to mention comparatively high unemployment: Catawba County joblessness was 11.8 percent in February.

High-wage pharmaceuticals and computers

Encouragingly, strong new clusters of manufacturing specialties have emerged in the Carolinas in two of the highest-paying manufacturing sectors: “pharmaceuticals and medicine” and “computer and electronic parts.” Average wages in those sectors in 2010 were $101,787 and $93,113, respectively. The high wages in these industries help explain the high manufacturing wages in the Durham-Chapel Hill MSA . The Durham metro has the highest degree of specialization in pharmaceutical and medicine manufacturing in the United States and ranks No. 5 in specialization in computer and electronic product manufacturing.

The pharmaceutical and medicine specialization is also a regional strength. Eight Carolina metros are more specialized in pharmaceutical and medicine manufacturing than the national average: Durham, Florence (S.C.); both Greenvilles, Greensboro, Hickory, Raleigh and Rocky Mount. Five MSAs in the Carolinas have a higher degree of specialization in computer and electronic parts: Burlington, Durham, Greensboro, Raleigh and Rocky Mount.

Autos and tires

The Carolinas have also built specializations in motor vehicle and the related sector of plastics and rubber products. Spartanburg’s BMW plant is a well-known example of this sector. Freightliner truck manufacturing plants in the towns of Gaffney, S.C., and Cleveland, N.C., fall outside metro areas, so are not represented in these maps, but they still add to the regional specialization. These are encouraging trends, as both industries have higher average wages than the overall average U.S. wage. Motor vehicles and parts also have a higher average wage than the average manufacturing wage.

Other maps show weaker specializations within manufacturing sectors of chemicals, primary metals and machinery. These are less significant concentrations than the others listed, although they offer comparatively higher average wages than manufacturing as a whole.

Building on strength, creating new opportunities

The evolving geography of manufacturing in the Carolinas offers challenges for metro areas with concentrations of low-wage manufacturing. The recent Brookings report, Locating American Manufacturing: Trends in the Geography of Production, which supplied the specialization index used in the maps above, shows nine MSAs in the Carolinas have existing clusters of low-wage manufacturing: Anderson (S.C.), Burlington, Florence (S.C.). Greenville (S.C.), Greensboro, Hickory, Spartanburg (S.C.), Rocky Mount and Winston-Salem.

The same Brookings report highlights the important role public policy has played in creating many of the new areas of manufacturing strength. A clear example in North Carolina is the Research Triangle Park, now with some of nation’s the highest manufacturing wages.

“The manufacturing wages in the Durham and Chapel Hill metro, buoyed by success in the pharma and high tech applications segments, are mind boggling, particularly in a state where manufacturing wages have been traditionally among the lowest in the country,” said Bill McCoy, director emeritus of the UNC Charlotte Urban Institute. However, he noted, that manufacturing activity is concentrated in the Triangle area, with little in the rest of the state.

Individual communities may be able to capitalize on existing or emerging strengths, but coordinated, strategic policy has been critical in creating many of these opportunities. “It is the make-up of the new manufacturing, and particularly the attendant high wages, that leads to an optimism about the long-term future of the our two states,” McCoy said.

Keith Waters wrote this article while a graduate student working at the UNC Charlotte Urban Institute in 2012-2013.

* Brookings, Locating American Manufacturing, April 2012 Areas highlighted on maps represent Metropolitan Statistical Areas (MSAs) as defined by the U.S. Census Bureau. Individual values of specialization index are available from the interactive map at Brookings.

Keith Waters