Is retail’s future on display in region?

At a rural crossroads 30 miles from Charlotte, an experiment is under way that could reshape the national retail landscape.

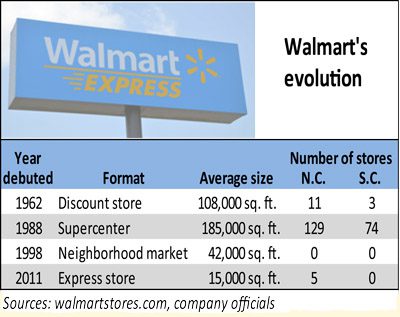

Walmart, famous for its ubiquitous supercenters averaging 185,000 square feet, is testing a much smaller, 15,000-square-foot format called a Walmart Express store in the Stanly County town of Richfield, population 516.

The Richfield store, newly built between a Food Lion-anchored strip center and a Dollar General near N.C. 49 and U.S. 52, is one of only 10 Walmart Express Stores in the nation – so far.

Several other national retailers – including Target, Kohl’s, Office Depot and Best Buy – also are reportedly toying with smaller formats, leading some observers to wonder if the days of seemingly endless, ever-larger stores are numbered.

Walmart’s Express format is about the size of a CVS or Walgreens drug store. It debuted last June in the company’s home state of Arkansas, came to Richfield the same month and has since spread to four other N.C. locations: Ayden and Snow Hill in Eastern North Carolina and Midway and Yanceyville in the northern Piedmont.

The format is intended to help Walmart reach customers who don’t have access to its larger stores. The company is testing the format in two different settings: sparsely populated rural areas such as Richfield, and urban areas such as downtown Chicago where space is at a premium.

Town administrator Carolyn Capps described Richfield’s Walmart Express as a hybrid between the grocery store on one side and the dollar store on the other.

The store, which sits across N.C. 49 from Town Hall, is a 12.8-mile drive from the nearest Supercenter in Albemarle.

The store, which sits across N.C. 49 from Town Hall, is a 12.8-mile drive from the nearest Supercenter in Albemarle.

Inside, six of its 11 aisles are devoted to groceries, including beer, wine and fresh produce, dairy and meat. The rest hold general merchandise such as toys, bedding, greeting cards, DVDs, motor oil and pet and office supplies. A pharmacist staffs a counter in the front corner.

A Redbox movie rental machine stands outside near the entrance, and a collection of plants and potting soil are for sale.

At each Express store, the company tries to tailor the product selection to local customers’ needs. As a sign on the front door boasts, the Richfield store sells live worms.

The store accepts federal food stamps, and Walmart.com customers can receive free shipping when they pick up orders at the store.

Walmart spokesman Bill Wertz said the Express format is part of the company’s efforts to match its stores to their surroundings.

“We really want the size and format of our stores to reflect the communities and the neighborhoods where they’re located,” he said.

In addition to Supercenters and Express stores, the company also builds two intermediate-sized formats:

- Discount stores, the company’s original format dating to 1962, average 108,000 square feet. The company is increasingly eschewing this format in favor of Supercenters, Wertz said.

- Neighborhood markets, which Walmart began building in 1998, are about 42,000 square feet.

Wertz said the Express format is performing very well in its trial phase, but company officials emphasize Supercenters remain their top priority and the best format for capturing market share.

Nevertheless, Bill Graves, associate professor of geography at UNC Charlotte, suspects the era of suburban big-box stores could be fading. With population growth shifting from suburban to urban areas and mobility suffering as gas costs hover near $4 a gallon, Walmart and other national retailers appear to be running out of viable places to build megastores, said Graves, who teaches about retail location, site selection and North Carolina’s economy.

Nevertheless, Bill Graves, associate professor of geography at UNC Charlotte, suspects the era of suburban big-box stores could be fading. With population growth shifting from suburban to urban areas and mobility suffering as gas costs hover near $4 a gallon, Walmart and other national retailers appear to be running out of viable places to build megastores, said Graves, who teaches about retail location, site selection and North Carolina’s economy.

“The smaller outlets are a way to infill in between those superstores a bit,” he said.

Walmart’s example could speed infill development in places such as Charlotte’s South End, which is “screaming for” another grocery store but lacks a good place, Graves said.

A Walmart Express-type store could more easily fit in the neighborhood while still providing a relatively full line of groceries, he said.

“This is going to open a lot of doors for neighborhood-level retail,” Graves said.

Walmart Express is not the company’s sole venture into smaller stores.

Walmart opened a 3,500-square-foot store on the University of Arkansas campus in Fayetteville, Ark., early last year. Over the holidays, the company operated two even smaller stores designed to ease customers’ access to Walmart.com, one in a California shopping mall and one in downtown San Diego.

Internationally, Walmart operates small-format stores in countries such as Brazil and Japan, Wertz said.

Graves said it’s not clear how Walmart’s forays into the domestic small-store business will affect places like Richfield.

The rise of smaller Walmarts will hurt existing stores, but the Express format offers a different model than a traditional rural grocery store, so the damage might not be severe, he said in an email.

A competing grocer reportedly closed two months after Walmart opened an Express store in Gentry, Ark., but nothing of that sort has occurred in Richfield, Capps said.

She speculated the Walmart might have taken some business from the neighboring Food Lion but seems to have helped the Dollar General. Some customers park at one and then walk to the other, she said.

Capps expects Walmart’s arrival will spur commercial growth. The town, which had 15 businesses when sewer service became available 15 years ago, now has 52. That total should grow once the planned widening of N.C. 49 from two to four lanes is complete, she said.

Walmart Express shopper Sylvia Coley, who lives midway between Concord and Richfield, doesn’t want the area overrun with growth but does want more options close to her home.

“I don’t want the explosion, but I would like to see something in Mount Pleasant,” she said, loading her trunk after a recent trip to the store.

She likes shopping there but still drives to larger stores for a more extensive selection of clothing and electrical and plumbing supplies.

Asked whether Richfield will ever attract a larger Walmart, Capps said she could foresee one somewhere in the northern part of Stanly County if people keep moving to the region.

“When Concord fills up, they’ve got to go somewhere,” she said.